Uncategorized

How to protect your devices against identity theft

ID fraud is growing in Canada. Follow these tips to protect your phone, tablet and laptop from cyber-criminals trying to steal your personal information.

Is 40 years old too late to build generational wealth?

For millennials who are getting a late start in investing, the worst thing to do is to panic, advisers say.

Affordable family vacations: How to travel when the Canadian dollar is weak

You can still plan an unforgettable, low-cost family vacation with these savvy strategies.

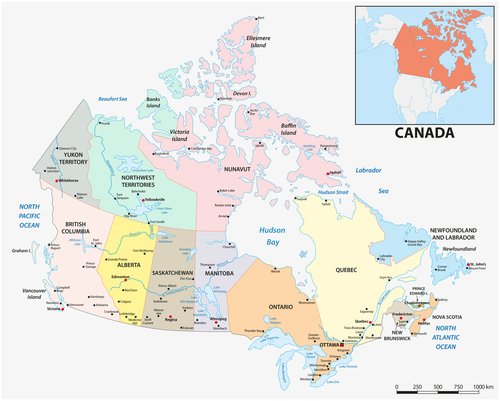

Unlocking Canada’s superpower potential

Capitalising on the G7 nation’s vast geography could spark an economic boom.

How to deal with your finances when the economy is stressing you out

Interest rates, inflation—not to mention tariffs or a recession—can make finances stressful. But keeping a cool head is important. Here’s how.

Technology Is the New Essential Cost in Retirement Planning

Technology and tech-enabled services are new costs in retirement planning and longevity preparedness.

Can AI Plan Your Next Vacation? A Golf Travel Test Drive In Scottsdale

More people are using AI for travel. But how well can it plan your next vacation? Can it help you with the best golf trip? Larry Olmsted went to Scottsdale to find out.

I’ve Interviewed Over 100 Entrepreneurs Who Started Businesses Worth $1 Million to $1 Billion or More. Here’s Some of Their Best Advice.

From Richard Branson to Martha Stewart and beyond, these founders reveal what it takes to build and lead successful companies.

How to protect your email account from scams and fraud

Identity theft is rising in Canada, and hacking email accounts is one of the sneakiest ways that scammers get your info. Here’s how to protect yourself.

Smart Business Owners Start at the End — How to Achieve Entrepreneurial Success by Taking a ‘Backward Approach’

This article advises entrepreneurs to take a “backward approach” to success by first articulating their end goal, then developing milestones, and finally creating a brand, partnerships and a team to execute.