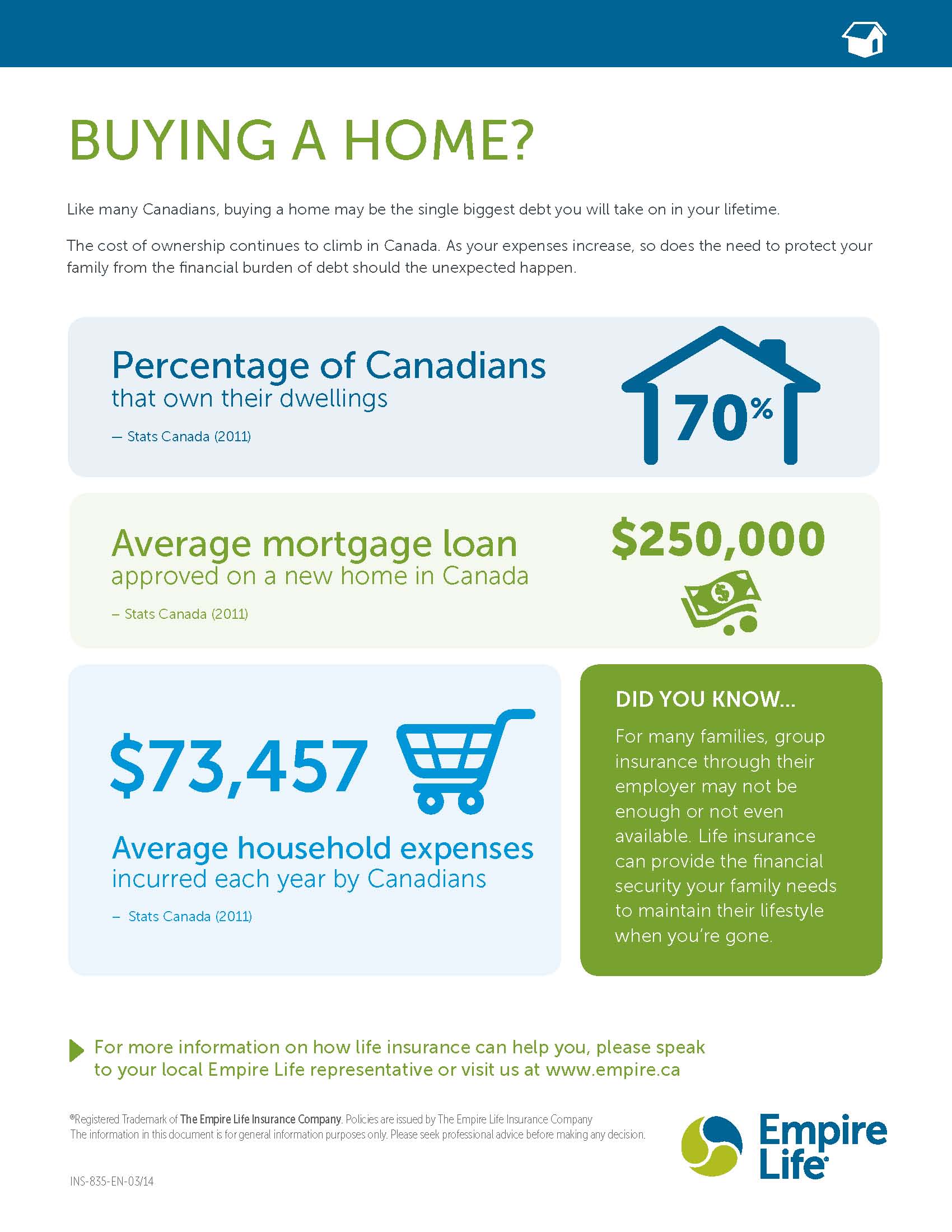

Buying a home is a huge goal for most Canadians. With 70% of Canadians owning their own home it’s not surprising that is a goal of most Canadians. It needs to be considered though, that costs are increasing quickly and with those increases come larger mortgages. What happens to your loved ones if you pass away? Will they be able to live in the house? What about their standard of living? Will they be able to keep the kids in the activities they love?

A solution to solve this conundrum is to look at life insurance as a solution. It’s a cost effective way to make sure your family will be able to make ends meet should you pass away and not be around to provide for them.

Stay tuned next week and we’ll show you the costs of covering off your mortgage and living expenses using life insurance. Alternatively, if you’d like to know now you can visit our partner site: http://www.lifeinsuranceadvice.ca/ and follow the instructions for an instant quote.

You can also contact Travis Strain at 604-308-6030 or mail@travisstrain.ca

Comments are closed.