If the federal government wants to score points with seniors, it will eliminate or roll back the requirement to make a minimum annual withdrawal from registered retirement income funds.

Eliminating the need to withdraw money from a RRIF each year would give seniors more flexibility in managing their retirement savings over increasingly long lifespans. But mandatory RRIF withdrawals aren’t as onerous as they’re sometimes made out to be. In no way do they force seniors to deplete their savings in a way that could cause them to run out of money.

iStock-1343586116

The C.D. Howe Institute recently described mandatory RRIF withdrawal requirements as being stuck in the past, and urged they be eliminated or relaxed. A collection of groups have urged the federal government to raise the age at which registered retirement savings plans must be converted into RRIFs, and reduce the required minimum withdrawal.

RRSPs must be converted to RRIFs by the end of the year you turn 71, at which point a rigid schedule of gradually increasing annual withdrawals must be followed. Mandatory RRIF withdrawals are intrusive, but manageable in a way that preserves your savings.

For example, you could make a cash withdrawal from a RRIF and then contribute the money to a tax-free savings account. The amount withdrawn from the RRIF is taxable, but using a TFSA means all future investment gains are tax-free.

Another option is to meet your obligation to make an RRIF withdrawal using an in-kind withdrawal, where you move shares or units in a mutual fund or exchange-traded fund into a taxable non-registered account.

The point here is that withdrawing from a RRIF does not automatically mean you are depleting your retirement savings. You have the option to remove money or assets from a RRIF and save or invest them elsewhere.

Tax must be paid on RRIF withdrawals of any type, but that’s the point. The federal government gave you a tax break on contributions to your RRSP, and it wants to gradually recover that money from your RRIF to help pay costs like health care and Old Age Security.

Mandatory RRIF withdrawals hit the news every time the stock market crashes. Seniors worry about having to cash in hard-hit investment to make their RRIF withdrawal, but that’s an entirely avoidable problem. Just keep two or three years’ worth of mandatory withdrawals in cash vehicles or other safe investments. Dip into this money instead of selling a wounded stock or fund.

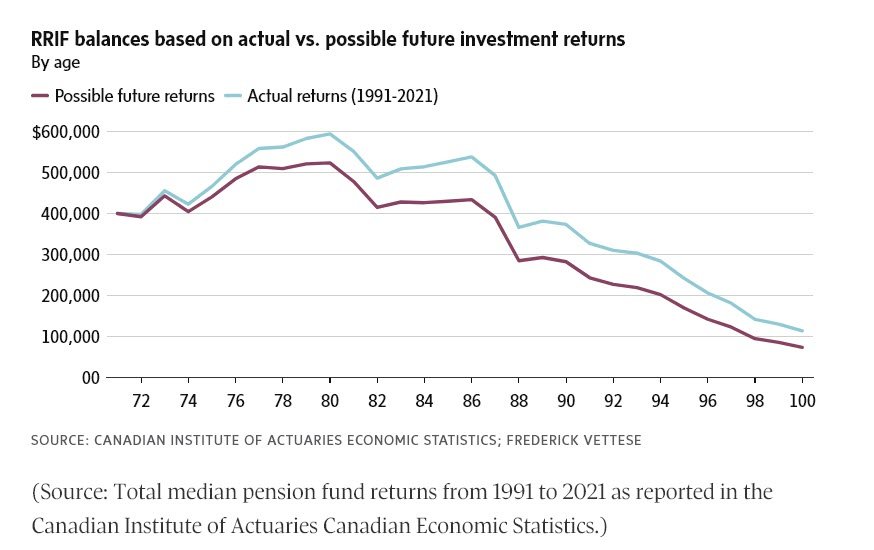

Finally, here’s a chart that shows how money in a RRIF may last longer than you think, even as you make annual required withdrawals.

Comments are closed.