Chances are at least some of what you think you know about inflation is wrong.

The same holds true for all of us. Not even the supposed experts claim immaculate foresight when it comes to predicting or managing inflation.

iStock-1309588996.jpg

Daniel Tarullo, a former governor of the Federal Reserve, has declared the Fed lacks a working theory of inflation. Prominent economists such as Jon Steinsson of the University of California, Berkeley, acknowledge “our very imperfect understanding of inflation.”

But that doesn’t mean any story goes. In corresponding with readers, I’m struck by how often three notions come up that are either outright wrong or not quite right. These three myths taint much of the conversation around the current outburst of inflation. It may help to look at each of them in turn.

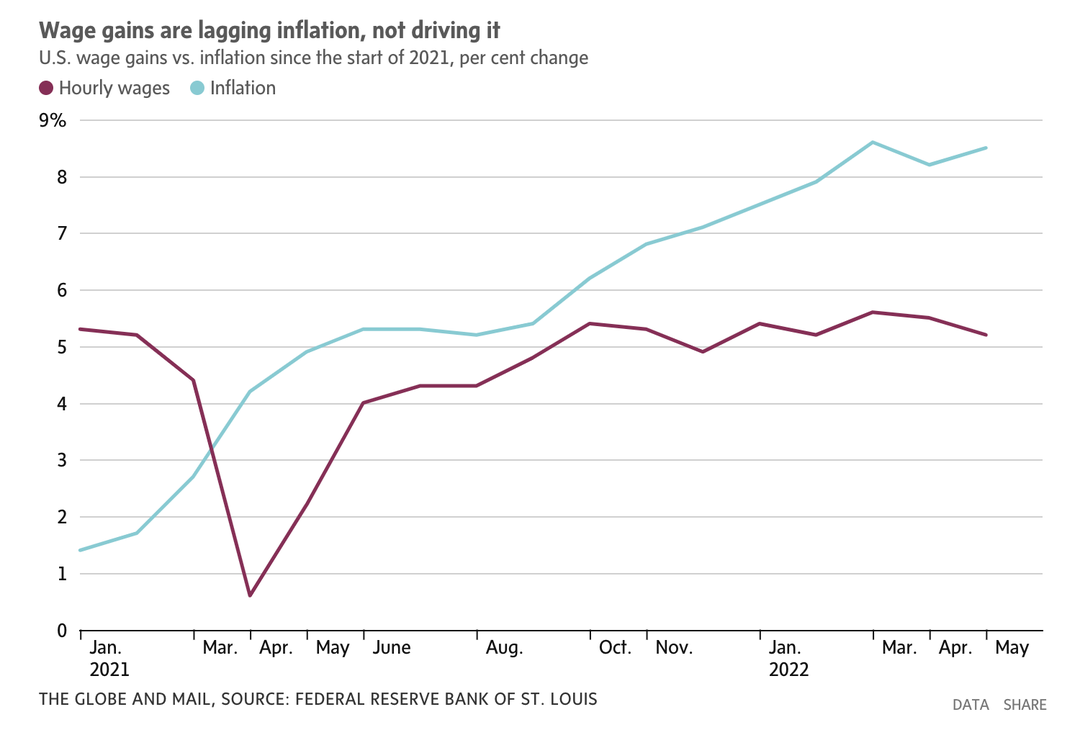

It’s all about greedy workers: One notion that comes up over and over again in reader e-mails is the conviction that inflation is the direct result of outrageous salary demands by workers. The push for a $15-an-hour minimum wage strikes many people as a prime reason for surging prices.

This just doesn’t fit the facts. Wages are growing at about 4 per cent a year in Canada. By comparison, inflation is running at 7.7 per cent.

In both Canada and the U.S., wage increases are lagging well behind inflation. Workers have not been grabbing a bigger share of the pie in recent months. If anything, they’ve been falling behind. This makes it exceedingly difficult to blame the inflationary surge over the past year and a half on runaway wage demands.

To be sure, this picture could change in the months ahead. It’s reasonable to expect workers to try to make up their lost purchasing power as they renegotiate salaries and push for higher wages. So far, though, real wages have been a victim of rising prices, not the primary driver of them.

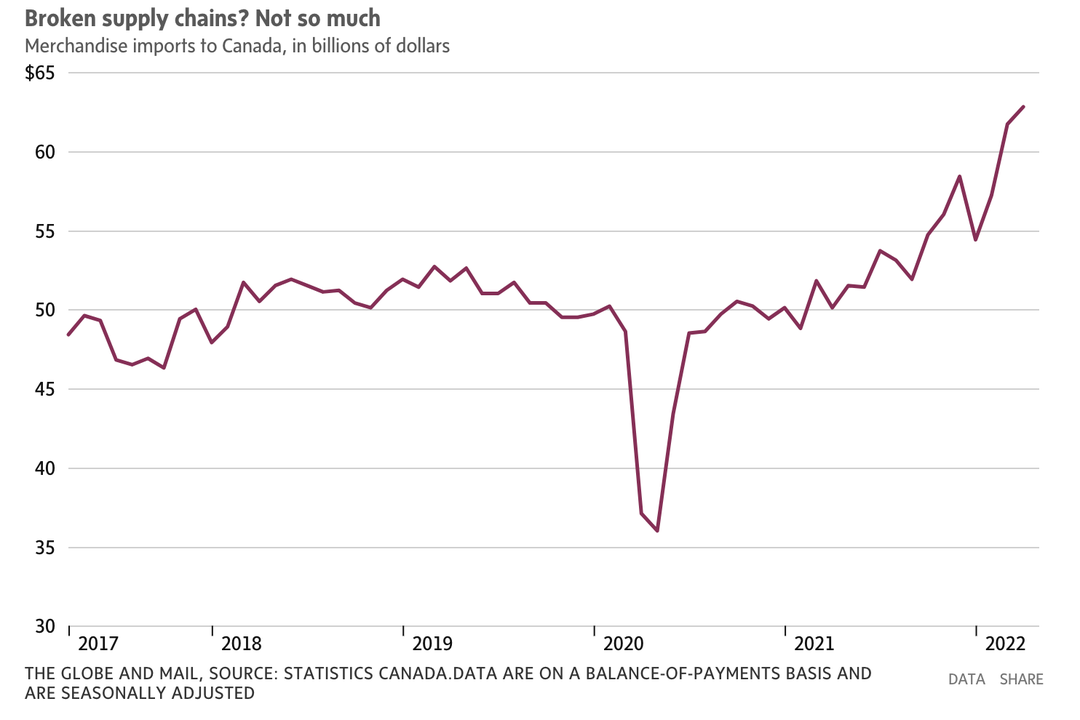

It’s all about broken supply chains: Another common notion is that inflation reflects the innate fragility of global supply chains that collapsed during the pandemic.

There is some truth to this, but not in the way most people think. Supply chains actually succeeded in delivering enormous amounts of foreign merchandise during the pandemic. Contrary to what many people think, imports of goods into Canada and the U.S. didn’t shrink over the past two years. They jumped to new highs.

This makes it difficult to blame faulty supply chains for inflation. A more plausible description of recent events is that demand surged to unprecedented levels and overwhelmed the capacity of supply chains to keep up.

It’s all about printing money: Another common notion is that central banks in Canada and the U.S. simply “printed money” to keep governments afloat in the pandemic and thereby stoked inflation. That is stretching the truth.

The quantitative easing programs run by the Bank of Canada and the U.S. Federal Reserve essentially consisted of central banks going out and buying government bonds on the open market from commercial banks. The central banks paid for them using a special type of central bank money known as reserves or settlement balances.

Reserves can’t be used by commercial banks to make loans to consumers or businesses. They can only be used to settle obligations between banks. As a result, their ability to drive inflation is severely limited.

The bonds that central banks purchased didn’t disappear. Governments still had to pay them off. But the large-scale purchases of those bonds did change the composition of what commercial banks owned. They used to hold bonds; now they held assets at the central bank – assets that could only be used under certain, rather limited conditions.

Why did any of this matter? Among other things, the bond buying by central banks served to push up the prices on bonds and therefore push down their yields – that is, the interest rate they paid to bondholders. (Bond yields move in the opposite direction to bond prices.) This kept longer-term interest rates lower than they otherwise would have been and encouraged more lending and buying.

You can argue that lower rates can help stoke inflation and you are probably right. Lower rates, though, are desirable when economies are facing a downturn caused by big stresses like a pandemic. And the bond buying that drives rates lower is eventually reversed, either by the bonds maturing or by the central bank selling off the bonds.

All of this is admittedly an arcane process. But it’s not what most people think of when they hear “money printing.” History shows it is not necessarily inflationary either. The Bank of Japan practised quantitative easing for years without any big spike in inflation. So did the Federal Reserve a decade ago.

So if all these theories fall short, what is a more correct explanation for today’s raging inflation?

The sturdiest story seems to be that it began when North American governments delivered too much stimulus during the pandemic. This set off a huge wave of unexpected demand.

Unusually, the demand focused on goods. This seems to have happened because people were locked down and many service businesses were closed. Goods prices soared as people avoided travel and restaurants and turned instead to buying new gadgets or splurging on home renovation.

It then appears that the resulting inflation widened, probably as a result of the stresses that went along with reopening economies. Inflation then got a further boost when Russia invaded Ukraine, sending food and oil prices to new highs.

Granted, this is a messy, multi-part explanation. It will nearly certainly prove to be wrong-headed in some respects. But at least it sticks to what we can say with reasonable confidence, unlike some of the theories out there.

Comments are closed.