As investors continue their search for yield in a low-yield environment they should look closely at dividend-paying companies which have historically provided higher returns with less volatility than non-dividend-paying companies. In fact for the first time in more than 50 years, the dividend yield of many equity indicies are higher than bond yields. This is good news for those investors who are worried about the potential volatility that their bond investments may experience when interest rates begin to back up, perhaps as soon as 2013. History has also proven that dividends form an important part of an investment’s total return even in environments of challenging and uncertain economic growth.

The Advantage of Dividends

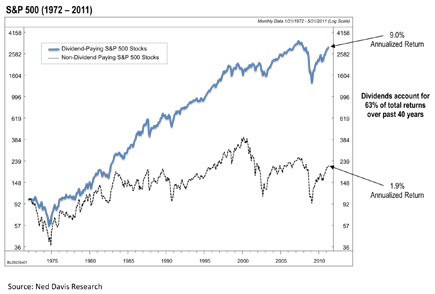

Dividends form an important part of a stock’s total return and, as the Chart below shows since 1972, dividends have accounted for more than 60% of the total return of the S&P 500 Index.

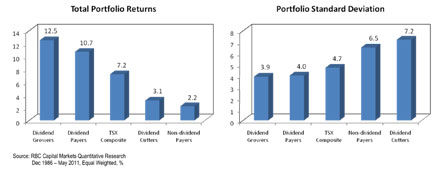

Within dividend-paying companies, risk and return differences exist as companies classified as “Dividend Growers” have provided superior results with less volatility than all other dividend and non-dividend-paying companies.

Not surprising, these types of companies are, typically, characterized with strong balance sheets, are competitively positioned and have experienced corporate management teams. These positive characteristics help ensure the company’s earnings and cashflow will support future dividend payouts.

Risk Appetites Have Changed

History has also shown that during the early stages of an economic downturn, investors shift out of riskier investments (often non-dividend-paying) as these stocks often fall much further in price than higher quality companies. Not surprisingly, these risky companies, typically, then experience greater upside price appreciation during economic expansion. This “junk” rally can last for some time; however, eventually, dividend-paying high-quality stocks reclaim their performance advantage.

The 2009-2011 recovery from the Great Recession followed this historical pattern that saw a rapid rebound of low-quality stocks as investor sentiment moved from fear to optimism. Government-provided liquidity such as the Quantitative Easing Programs enacted by the U.S. Federal Reserve, further boosted investor confidence and helped to fuel this low-quality rally even further. Quality Dividend Payers had strong results during this expansionary period however, underperformed the riskier names. As the junk rally faded, investors who maintained their exposure to dividend-paying stocks were rewarded as GDP growth estimates were ratcheted down.

Currently, economic headwinds continue worldwide. The European debt crisis is not yet solved, U.S. unemployment remains high (although showing some signs of improvement), and China’s slowing growth have all caused investors to move out of riskier assets and into perceived safe-haven investments.

Although macroeconomic news is less positive, corporate earnings continue to be strong. During the recession many companies, in efforts to strengthen margins reduced their expenses, and as a result, their profits increased during the 2009-2011 expansion. Corporations took advantage of the historically low borrowing costs to reduce their debt and shore up their balance sheets.

Stocks in Times of Inflation and Rate Hikes

Economic growth will be challenging and central banks are well aware of inflationary threats. In terms of dividend-growing companies and the impact of inflation, the S&P 500 Index had an average annual dividend growth rate of 5.6% since 1947, versus the average annual U.S. CPI of 3.7%. In other words, the income from dividend-paying stocks had risen faster than the decline of U.S. purchasing power.

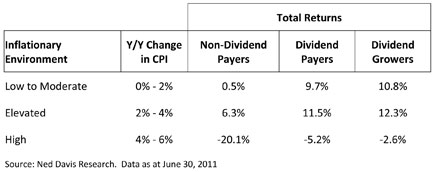

Furthermore, as shown in the Table below, Dividend Growers and Dividend Payers have outperformed Non-Dividend Payers across a variety of inflationary environments.

There is a strong relationship between dividend growth and earnings growth during inflationary times. For the most part, the purchasing power of higher quality corporations is maintained due to their competitive advantages, such as their dominant market share, high barriers to entry and continued demand for their products and services. During inflationary times, corporations continue to maintain their margins and cashflow growth which supports their dividend payout.

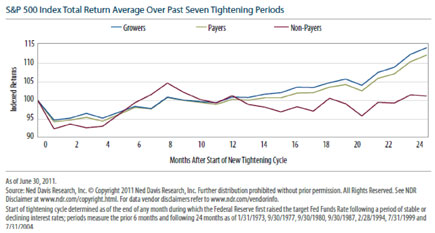

When the global economies eventually recover, central banks may raise interest rates in efforts to contain inflation. This tightening phase may hinder stock price appreciation; however, dividends will continue to be a valuable component of total return. This is illustrated in the Chart below which compares the returns of Dividend Growers, Dividend Payers and Non-Dividend Payers in post-tightening cycles. All experienced negative results for several months after interest rates rose. However, Dividend Growers and Dividend Payers recovered their losses approximately twelve months after the tightening and their strong results continued upwards. In comparison, Non-Dividend Payers initially recovered more quickly however, on average, their long-term results lagged.

Summary

With the macroeconomic uncertainty, and no easy resolution to the European debt crisis, dividend-paying stocks provide defensive characteristics. As investor’s risk appetites move away from low-yielding and low-quality companies, high-quality dividend-paying stocks may be best positioned to deliver solid total returns to investors. These dividend-paying stocks offer significant fundamental and cyclical advantages which perform well during inflationary and tightening phases.

Over the long-run, dividend-paying stocks have outperformed non-dividend-paying companies and with lower volatility. These stocks offer the best potential for total return with sustainable dividend increases, specifically, during our current period of heightened global economic uncertainty.

Travis

Comments are closed.