The long-expected correction in Canada’s housing market is underway, but what is surprising observers is how quickly it’s happening.

iStock-622450552.jpg

Data from the Canadian Real Estate Association yesterday showed that seasonally adjusted existing home sales fell 8.6% in May from the month before, down 21.7% from a year ago.

For the first time since the pandemic rally began home resales on a national level dropped below levels recorded in February 2020, said RBC assistant chief economist Robert Hogue.

“What is surprising is how fast we got here,” said CREA senior economist Shaun Cathcart yesterday after the data came out. “With the now very steep expected pace of Bank of Canada rate hikes, and fixed mortgage rates getting way out in front of those, instead of playing out steadily over two years, that cooling off of sales and prices seems to have mostly played out over the last two months.”

Interest rates and psychology might explain that.

Mortgage rates have gone from lows of about 1.5% to close to 5% for five-year fixed and variable rates are headed for 4%-to-4.5% by year-end, said BMO senior economist Robert Kavcic. Stress tests (the contract rate plus 200 bps) are now nearing 7%.

“By late-summer, any still-favourable rate holds will be gone, and this new interest-rate reality will be fully sinking in,” he wrote.

Psychology is also at work. Early this year Canadians widely expected home prices to keep rising, (a record 64%, according to Nanos survey data) and this caused many buyers to stretch their finances for fear of missing out, said Kavcic.

“But, beginning with the Bank’s first nudge in interest rates, those market expectations began crumbling.”

Now less than 44% expect higher prices this year and 23% expect lower prices, up from less than 6% early in the year.

“We’ve long argued that breaking the market psychology was the key to settling conditions back down, and that deed now looks to be about done,” Kavcic said.

The big questions now are how far prices will slide and what effect, if any, it will have on the economy.

RBC thinks that as the Bank of Canada continues to raise rates home prices will fall about 10% nationwide and closer to 13% in the more expensive markets of Ontario and British Columbia.

Globally, Canada has been identified as one of the more vulnerable housing markets.

Capital Economics sees prices falling between 5% and 20% in Canada, New Zealand, Australia, Sweden, the U.K. and Norway, but says there is risk of steeper drops. For comparison, it sees the U.S. prices just flatlining.

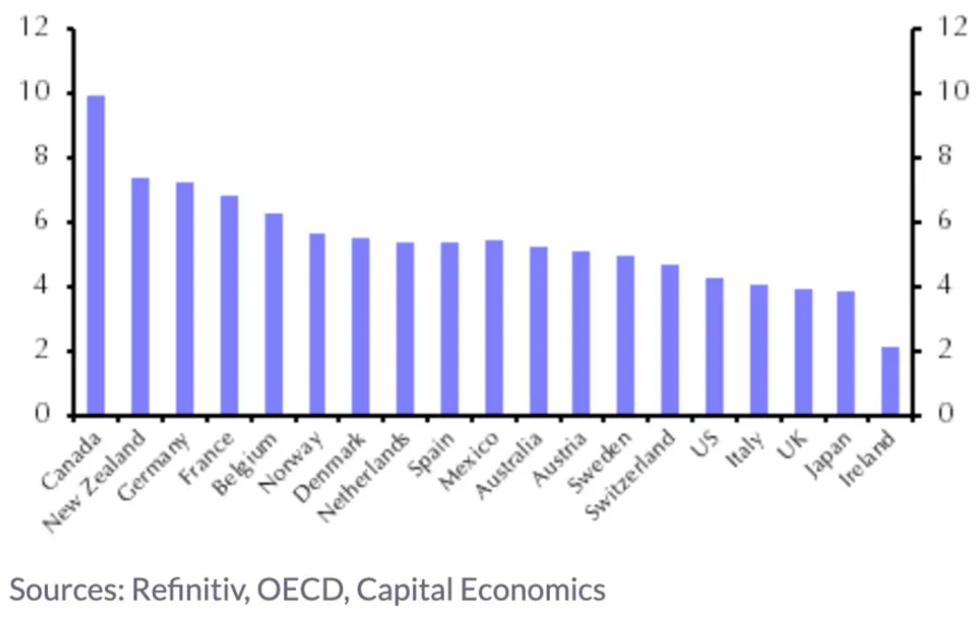

Chart: Residential Investment (Percentage of GDP, 2020-21)

Falling home prices will drag on economic growth, though the effects may not be felt until next year. Capital expects drops of 10% to 20% in residential investment as it becomes less profitable to build homes, which could knock 0.5% to 1% off GDP. Canada looks especially vulnerable to this, said Capital’s senior economic adviser Vicky Redwood.

Housing corrections won’t stop central banks from raising rates, but countries that see large price drops are more likely to see rates peak at a lower level, she said.

“This is a reason why we expect the peak in interest rates to be lower in Canada than the U.S.”

Comments are closed.