Canada’s prime interest rate should climb in the first half of 2022, but if you’re contemplating a variable rate, that’s not the only concern. How long the prime rate stays higher is just as important.

Most who plan to float their mortgage rate for the next five years are betting that their average rate over that time frame will be lower than a comparable fixed rate. If that’s your bet, here are two things that could limit how long rates stay elevated:

iStock-1316707586.jpg

Extreme debt levels

When people have too much debt, they can’t buy as much. The economy then needs more rate stimulus to keep inflation near the Bank of Canada’s 2-per-cent target. But consider that no less than 25 per cent of domestic demand now comes from interest-sensitive private activity, a record that National Bank Financial says is “fully attributable to Canada’s outsized reliance on housing.” What’s more, a record 26 per cent of new mortgages have extreme loan-to-income ratios, the Bank of Canada says. Our central bank heavily weighs such factors when setting rates – which is why National Bank sees “a little doing a lot” when it comes to coming rate hikes.

Home price risk

History has shown that asset bubbles cause the worst recessions, and they can hammer interest rates. People can debate whether we’re in a bubble, but one thing is undebatable: The value of Canadian real estate has now reached a stunning 500 per cent of total disposable income, more than any time in history and more than almost any other country.

On top of that, we’ve now got a flood of investors causing “extrapolative price expectations,” as the Bank of Canada calls it. That makes a correction more likely, it says.

The biggest question is: How will housing hold up to higher rates? Record-low rates have been the No. 1 lever on the demand side for home prices, and rising rates would make that lever work in reverse. To put that another way, higher rates can lead to price exhaustion when not enough people can afford – or want to afford – an average home’s mortgage payment.

The Bank of Canada’s view is that weaker housing is “inevitable,” a concerning thought given a record 10 per cent of our economy now depends on residential investment. That should interest mortgagors for multiple reasons, not the least of which is that housing sell-offs have adverse wealth effects, which can lead to even lower interest rates.

How the above might affect the next interest rate cycle is uncertain. The Bank of Canada’s past six rate-hike sequences lasted about 12 months on average. With core inflation near a three-decade high, financial markets expect this one to last at least 24 months, according to Bloomberg implied rate data.

Speaking of inflation, it remains the wild card. Historically, inflation hasn’t peaked until 12 months after the Bank of Canada started raising rates, on average, National Bank says. If prices keep surging in 2022 before abating, that could lead the central bank to overtighten and slow the economy too much, leading to a top in rates around 2023-24.

As I wrote last time, the rate premium of fixed mortgages still seems warranted based on the market’s rate outlook. But paying up to lock in is getting dicier, given potential economic risk two to three years from now.

The takeaway for mortgage shoppers: Higher borrowing costs beget lower borrowing costs. The more that five-year fixed mortgage rates rise relative to variable rates, the more that matters. And that fixed-variable gap is already near a long-term high of 1.20 percentage points.

If you choose a leading rate (see accompanying table) on an uninsured mortgage, my rate simulations suggest one thing. Despite inflation being a serious rate risk, if inflation does abate by 2023 – as the Bank of Canada projects – then the more you pay above 2.59 per cent for a five-year fixed, the less likely you’ll beat a variable rate.

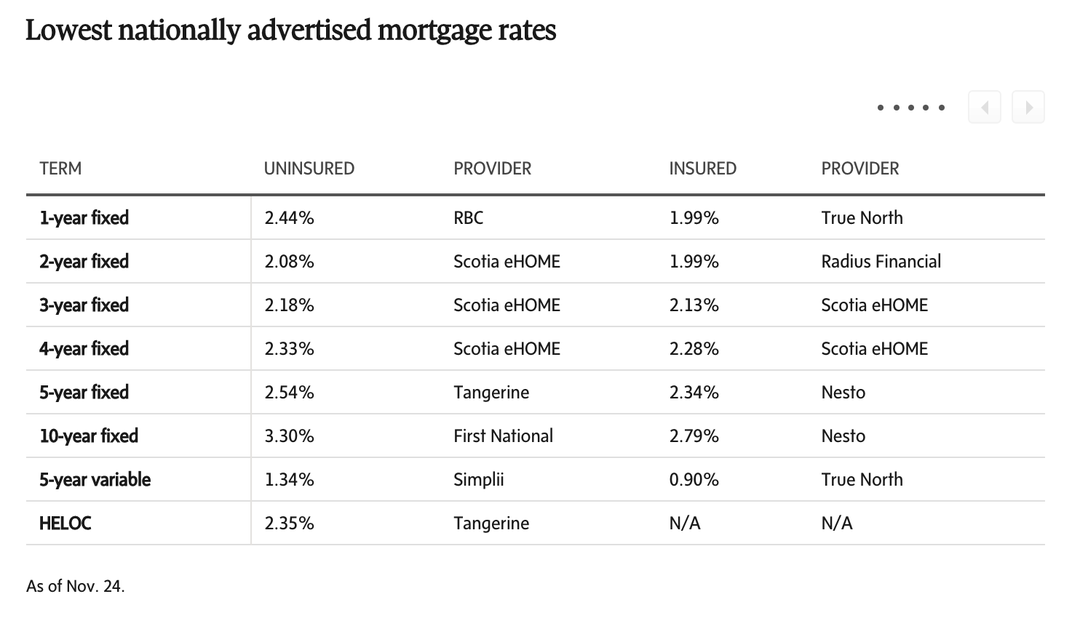

Rate check

The lowest uninsured mortgage rates held steady this week.

If you’re putting down less than 20 per cent, however, you can still find default-insured five-year fixed rates as low as 2.02 per cent in Alberta, B.C. and Ontario, compared with 2.34 per cent nationally. Just be mindful that these cheapo rates may have serious refinance restrictions. Don’t bite on these restrictive mortgages unless you’re certain you won’t need to sell or remortgage in the next five years.

Rates shown are as of Nov. 24, 2024, from providers that lend in at least nine provinces and advertise rates on their websites. Insured rates apply to those buying with a down payment of less than 20 per cent, or those switching a pre-existing insured mortgage to a new lender. Uninsured rates apply to refinances and purchases of more than $1-million and may include applicable lender rate premiums.

Comments are closed.