The Bank of Canada is poised to raise its benchmark interest rate on Wednesday for the first time since 2018, a move that will affect the cost of borrowing for various loans, including mortgages.

iStock-185302077.jpg

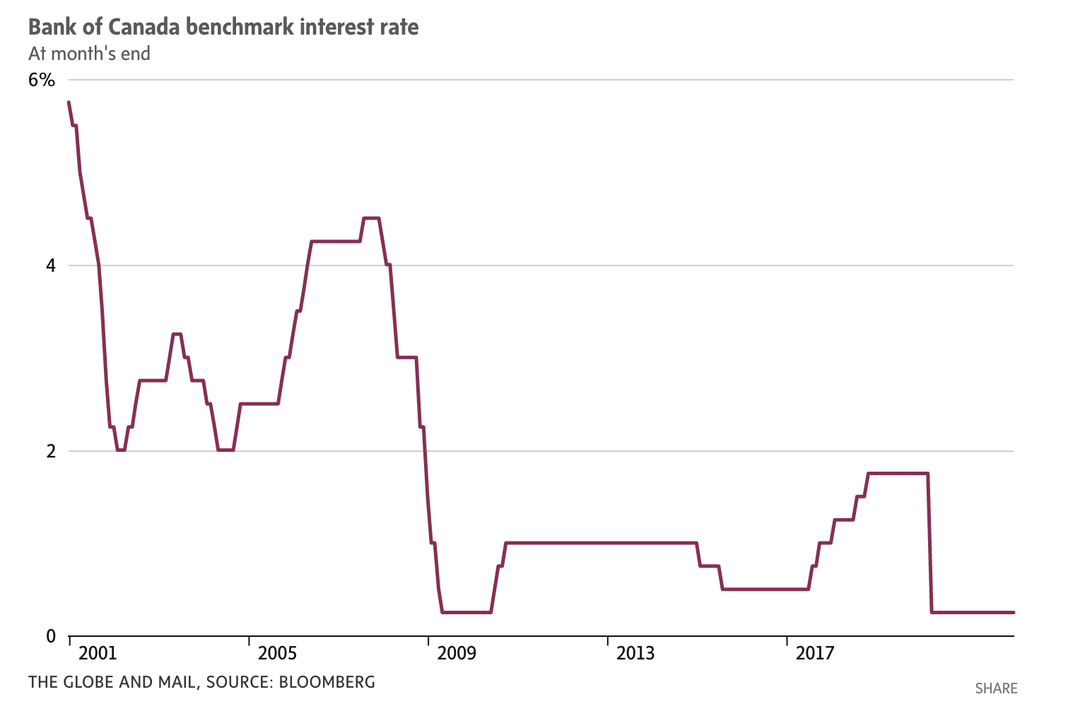

Since the early days of the pandemic, the bank’s benchmark rate – also known as the policy rate or key rate – has stood at 0.25 per cent, matching a record low set in the aftermath of the global financial crisis of 2008.

Those ultralow rates have undoubtedly poured fuel on the housing market, which has experienced frenzied activity and rapidly increasing prices for much of the past two years, despite economic troubles.

Now, things are changing, with a series or rate hikes expected this year and next. With that in mind, here is a guide to how the rate hike will affect homeowners and prospective buyers.

Homeowners with fixed-rate mortgages

There is no immediate impact on payments for existing mortgages. Only when the mortgage comes up for renewal would higher rates affect payments.

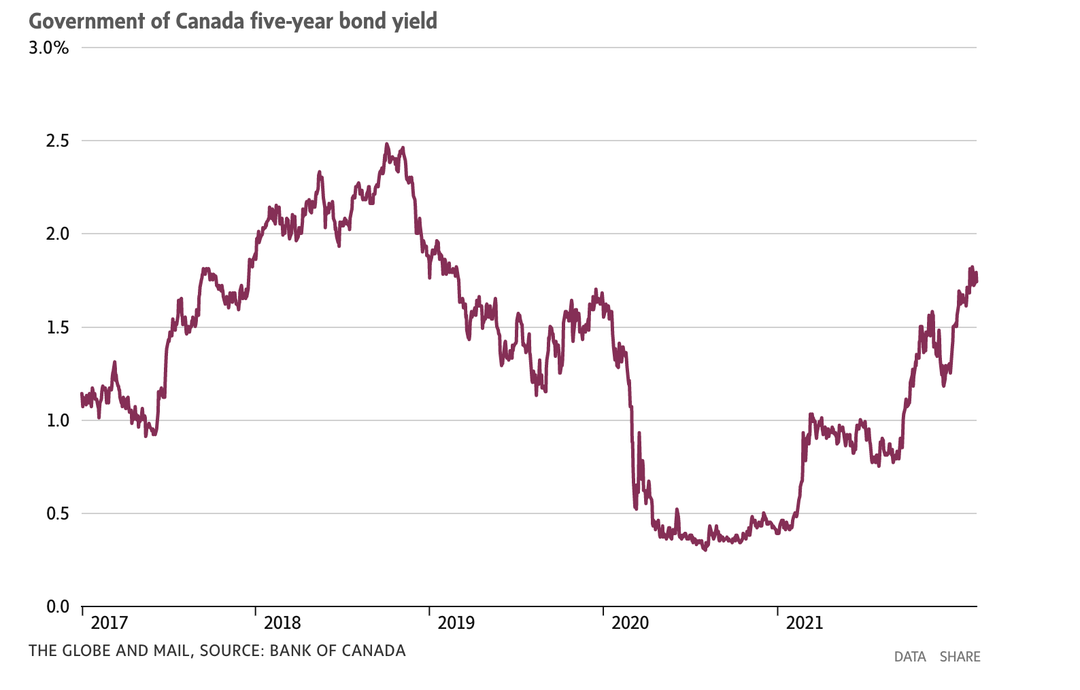

The interest rate on fixed-rate mortgages is influenced by the interest rates on bonds issued by the federal government, not the Bank of Canada’s benchmark rate.

But if the central bank is confident enough about the economy to start pushing the overnight rate higher, expect interest rates in the bond market to rise as well. This explains how an increase in the overnight rate can indirectly affect fixed-rate mortgages.

How will your mortgage payments change?

For those with a fixed-rate mortgage that will come up for renewal, we’ve created the following tool to see how your monthly payments could change.

First, figure out the mortgage amount remaining at the start of your next term, and the remaining amortization. (Talk to your mortgage lender to find out, or use a calculator to get a rough idea.) If you wish to compare mortgage payments, check your mortgage statement to find your current monthly payment. Finally, test out some higher interest rates than you’re now paying.

Homeowners with variable-rate mortgages

The interest cost on variable-rate mortgages is pegged to your lender’s prime rate, minus whatever discount you negotiated. The prime rate is in turn guided by the Bank of Canada’s benchmark rate. Payments on some variable-rate mortgages will be adjusted higher in a matter of days or weeks to reflect an increase in the overnight and prime rates.

With other variable-rate mortgages, payments remain the same for the duration of the term. But there are adjustments going on in the background. As rates rise, more of your payment goes toward paying interest and less goes toward the principal. This will increase the amount of time it takes to pay off your mortgage unless you increase payments on renewal.

One final note: Toronto-Dominion Bank is an example of a lender that has a “mortgage prime rate,” a unique in-house rate used for pricing variable-rate mortgages. TD’s mortgage prime has been higher than its conventional prime rate.

Prospective buyers

Recent buyers have already seen how mortgage rates can change in a hurry. Some of the best rates on five-year fixed-rate mortgages are around 2.7 per cent, while many Big Six banks are offering loans above 3 per cent, according to Ratehub.ca. At points in the pandemic, major banks had advertised five-year fixed-rate mortgages at less than 2 per cent, a sign of how the market is shifting amid higher inflation.

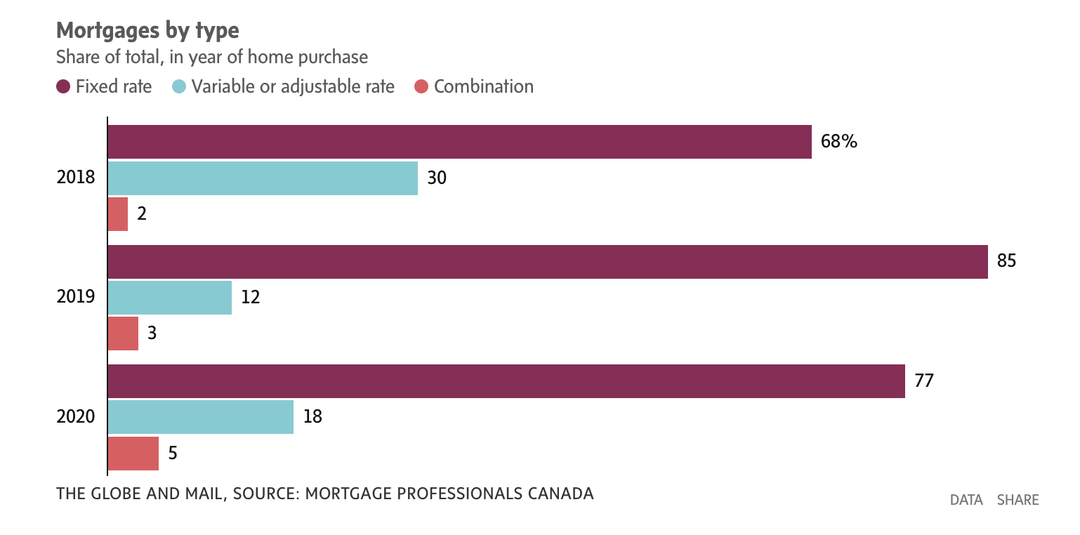

By comparison, variable-rate mortgages have lower interest rates, and their discount relative to fixed-rate mortgages has grown especially large of late. (Many of the five-year variable rates from discount brokerages are 1.35 per cent, at least for now, according to Ratehub.) Mortgagors have certainly taken notice: In recent months, a slight majority of borrowers have chosen variable rates.

Is variable still the way to go? That’s debatable. If the Bank of Canada is forced to raise rates aggressively to tame inflation, that could possibly extinguish the advantage for variable-rate mortgages.

Ultimately, hopeful buyers have to pass a stress test of their ability to afford mortgage payments at higher interest rates. Borrowers are tested at 5.25 per cent or their negotiated mortgage rate plus two percentage points – whichever is higher.

Still thinking of getting into the market? Here’s a tool to show how your monthly mortgage payments would differ at various interest rates.

Mortgage market breakdown

Despite the recent popularity of variable rates, about seven in 10 borrowers has a fixed-rate mortgage, according to survey results published in 2021 by the Canada Mortgage and Housing Corp. A slight majority of mortgagors has a five-year term.

Comments are closed.