Financial planning questions often revolve around investing and retirement planning, but it’s not often someone takes a keen interest in integrating life insurance into their financial plan unless they have come across a particular strategy.

Here are some things to think about when it comes to insurance and financial planning beyond the basic need for life insurance.

Substitute term insurance for mortgage insurance : If you have mortgage insurance with a bank or trust company, compare the premium cost to owning a term life insurance policy with a life insurance company.

iStock-960762192.jpg

You pay a fixed premium for the life of the mortgage when you buy mortgage insurance. As you pay down the mortgage, your premiums stay the same, but the insurance coverage reduces. If you pass away, the mortgage is paid off.

Compare this to purchasing term insurance with an insurance company. For example, if you and your spouse purchase two individual term insurance policies, the combined cost is often about the same cost as the mortgage insurance.

What is the advantage? With a $500,000 mortgage, you would each take out a $500,000 term policy. Should one of you pass, the other would receive $500,000 in cash with the option to pay off the mortgage. If you both pass — say, in an accident — your children would receive $1 million, the proceeds of both policies. Isn’t that better than leaving the kids a house without a mortgage?

Don’t let your term policy renew : Ten or 20-year terms are common if you own a term life policy, so it’s best to review and possibly replace the policy before it renews. This may be a three-month process so give yourself time.

Here’s why: A $250,000, 20-year term policy for a 25-year-old, non-smoking female is $14/month. Fast forward 20 years and the premium will jump to $75/month at renewal.

Today, a 45-year-old female can purchase the same policy for $32/month, a $43 difference. If rates remain the same 20 years from now, and you are still healthy, it will likely be cheaper to replace the existing policy with a new policy.

Purchase insurance based on your need : There’s term, whole life and universal life insurance, so which one should you buy?

Term insurance is inexpensive, and ideal when you are starting a family, buying a home, have debt and money is tight. Eventually, term insurance expires late in life or you will cancel it because the increasing premiums get too costly.

Whole life, on the other hand, is relatively expensive, the premiums never change and the policy will never expire. It also comes with a growing cash value and death benefit. It is ideal for estate planning purposes. A $250,000 whole life policy for a 25-year-old female is $235 a month, which is more than the $14 a month for the term policy, but it offers the longer-term benefit that your premium will not increase throughout your lifetime.

I have seen people buy small whole life policies because they like the idea of having a cash value, and yet they need a lot more coverage. Your survivors will be more concerned about the money they receive rather than the type of policy you had. Purchase a policy you can afford that gives you the coverage you need.

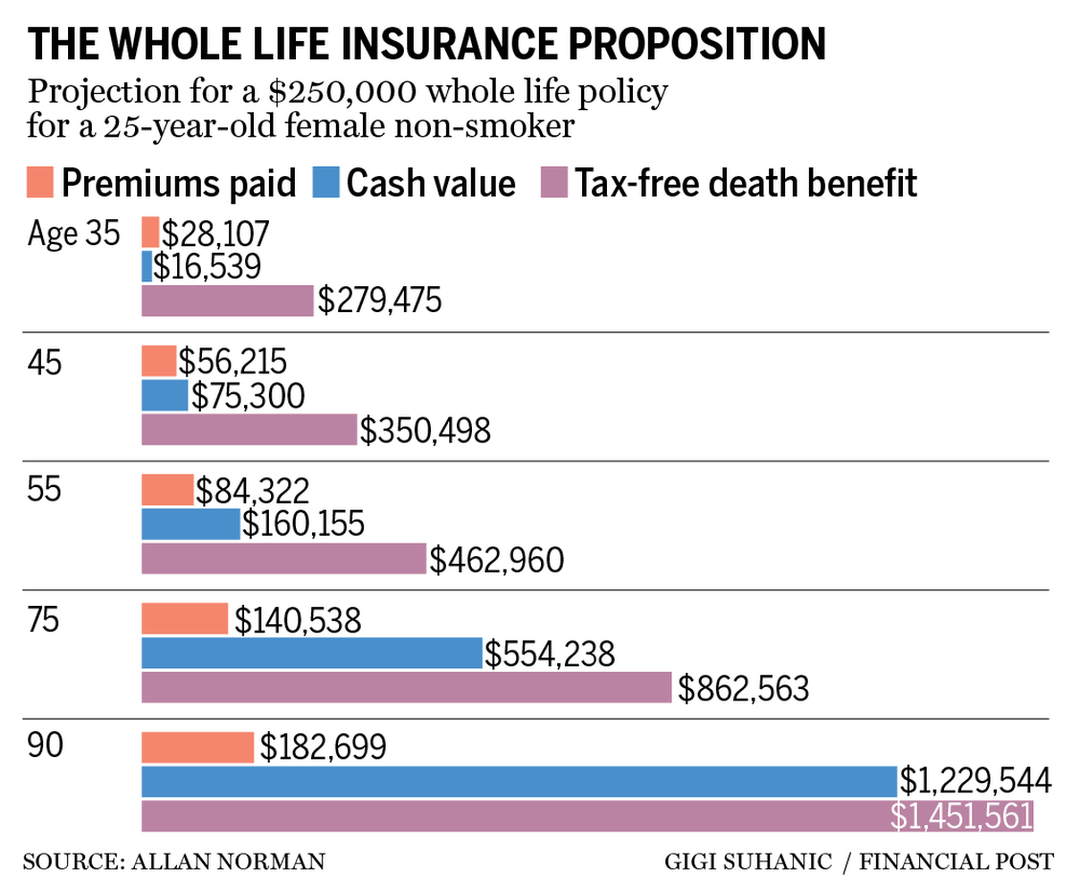

Whole life cash values (CVs) and death benefits grow over time. The accompanying table is a current projection from a major life insurance company. Keep in mind these numbers are not guaranteed and the actual results will be different.

Notice the rate of return on the cash value after 30 years, at age 55, is about four per cent. After 30 years, a good portion of that cash value will be taxable if you cancel the policy and take the cash, while the CV is tax sheltered in the policy.

The death benefit is projected to return five-per-cent tax free if death occurs at age 90, which isn’t bad in today’s financial environment. Inflation is the concern when projecting over such a long time frame.

Borrow to invest : Although you can borrow directly from your insurance cash value, some trust and insurance companies will give you a line of credit secured against your cash value. You can either borrow up to 100 per cent of the total cash value (and make interest payments), or you can borrow a lesser amount and allow the interest payments to accumulate inside the policy.

The minimum loan will be in the $35,000-to-$50,000 range with an interest charge of about prime plus one per cent, depending on the lender. If you borrow against the policy to invest, the interest will likely be tax deductible.

Similar to a reverse mortgage, you can also borrow against your insurance cash value to receive tax-free deposits into your bank account.

Corporate insurance : Purchasing an insurance policy inside your corporation can be very tax efficient. For example, a person living in Ontario with a $1,000 monthly insurance premium has to earn $2,150 before tax to have $1,000 left to pay the premium, assuming a 53.53-per-cent marginal tax rate.

A corporation in Ontario taxed at the small business rate of 12.2 per cent would have to earn $1,139 before tax just to make the same $1,000 premium payment. That is about a $1,000 difference, which also happens to be the insurance premium.

When you pass away and the insurance pays out, then almost all, if not all, will flow out of the corporation tax free through the capital dividend account. You can also use the cash value as security to borrow against the cash value and use it to fund retirement.

Two other ways to use whole life include making charitable contributions or to equalize an estate if you have assets such as a business, farm, cottage or rental properties. The insurance provides cash in an estate so one child can take the cash while the other keeps the property.

I have briefly touched on a few strategies and skipped the details, but insurance is an interesting product because of its tax-sheltered growth and tax-free death benefit. There is a cost to owning and implementing some of these insurance strategies, and there are often alternative solutions.

Before implementing a strategy, model it out with everything else you are doing. Like many strategies, they can sound good on their own, but not always when integrated with everything else.

Comments are closed.