Q: Is the 60/40 asset mix over because of the higher levels of correlation between stocks and bonds? What is the rationale for having an allocation to non-correlated assets or hedge-fund strategies in a long-term diversified portfolio? Is this type of allocation the “new normal”? — Mehmet

iStock-1346154041

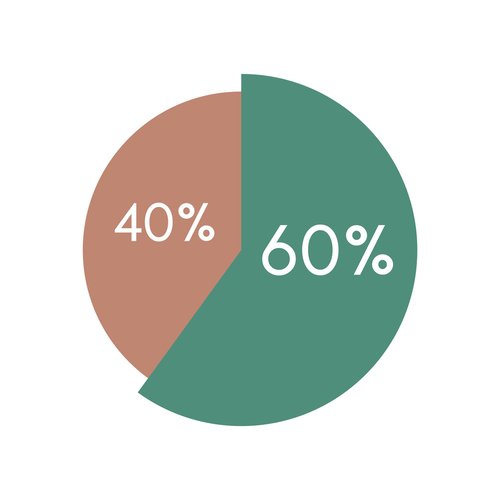

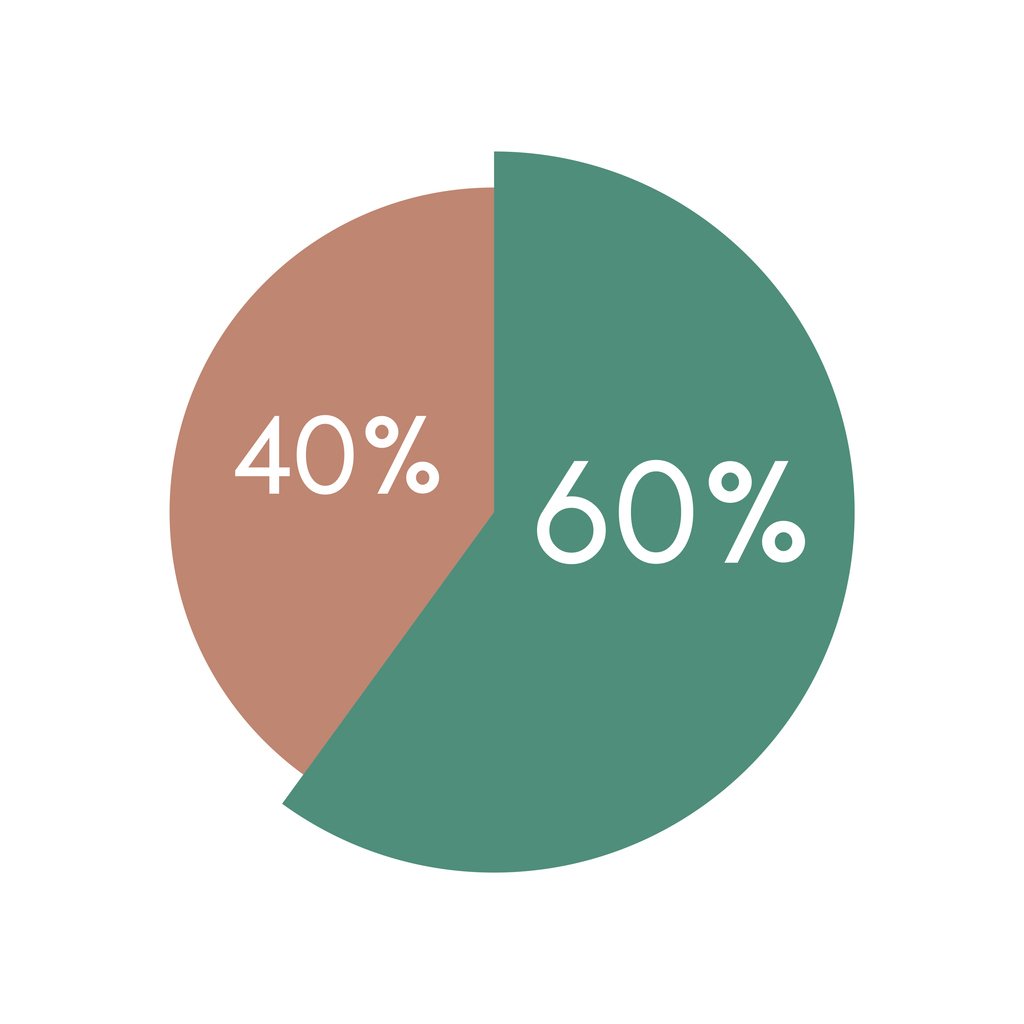

FP Answers: The 60/40 investment portfolio, typically composed of 60 per cent equities and 40 per cent bonds, is considered a traditional, balanced asset allocation suitable for the average investor. The rationale behind the weighting of fixed income and equities is to balance risk and return with a reasonable amount of volatility.

Equities represent the riskier portion, but they are also the main drivers of returns during good times, while investment-grade bonds provide the ballast in the portfolio since income generation and capital preservation offer protection in bad times. So far, so good.

Usually, equity and bond prices move in opposite directions from each other and have a consistently negative correlation. In other words, when one asset class is rising in value, the other is typically falling. In theory, this should smooth out volatility and generate modest yet positive returns over the long term. If equities sell off, investors gain protection from their fixed-income holdings.

Despite a commendable performance in November 2023, when the typical 60/40 portfolio returned more than nine per cent, the most since the December 1991 fall of the Soviet Union, this type of balanced portfolio can still provide plenty of unexpected jolts to investors.

In 2022, as the pace of inflation and rising interest rates quickened, the traditional correlation between equities and bonds turned positive, which became a big negative for investors. A Bloomberg index tracking a 60/40 mix was down 17 per cent in 2022.

The last time that equities and bonds moved together in a negative direction was in 1969, when the United States Federal Reserve was also raising interest rates in the face of rising inflation. Since 1926, bonds have posted negative annual returns 15 per cent of the time, while the 60/40 portfolio took a loss 23 per cent of the time.

Given that an enduring negative correlation between equities and bonds is not set in stone, what can the average investor do to smooth out potential volatility, protect capital and still aim to generate positive, real and risk-adjusted returns?

Adding a sleeve of alternative or hedge-fund strategies to a balanced portfolio may be prudent given that investors face a “new normal” era: greater uncertainty from economic and technological changes, geopolitical frictions and global warming, to name but a few of the challenges.

Alternative strategies do not fit into the conventional bucket of equities and bonds. They typically have a low correlation to these asset classes, thus adding diversification to a traditional portfolio.

Until 2019, regulatory restrictions limited access to hedge-fund strategies to high-net-worth individuals and institutional investors such as pension funds and family offices. These strategies are not new, but the average investor today has access to mutual funds that employ hedge-fund strategies.

Two examples of these types of strategies include a fixed-income, high-yield bond strategy with the flexibility to hedge market volatility to protect capital, and a merger-arbitrage strategy that seeks to generate profits via a merger or acquisition event.

One of the main reasons to diversify into a conservative hedging strategy is to add a layer of defence. These strategies aim to protect assets against market drawdowns because they are market neutral. This defends capital better, which creates a foundation for compounding value more safely over the long term. For investors who value tax efficiency, returns from hedging strategies are favourably taxed as capital gains, not income or dividends.

No one has a crystal ball to foretell the future, but it is reasonable to expect, at a minimum, ongoing uncertainty regarding inflation and interest rates. In this type of environment, an allocation to market-neutral investments can stabilize portfolios against unforeseen events.

Comments are closed.