Yes, until very recently, I thought complicated and complex were pretty well synonymous, too, but after reading General Stanley McChrystal’s book, Team of Teams, I was admonished and educated.

General Stanley McChrystal’s book, Team of Teams, geared toward leaders in business, walks us through the fascinating philosophical and practical framework required to bring together a myriad of the world’s elite fighting forces in pursuit of a common cause.

And the big takeaway for me was, “Being complex is different from being complicated.”

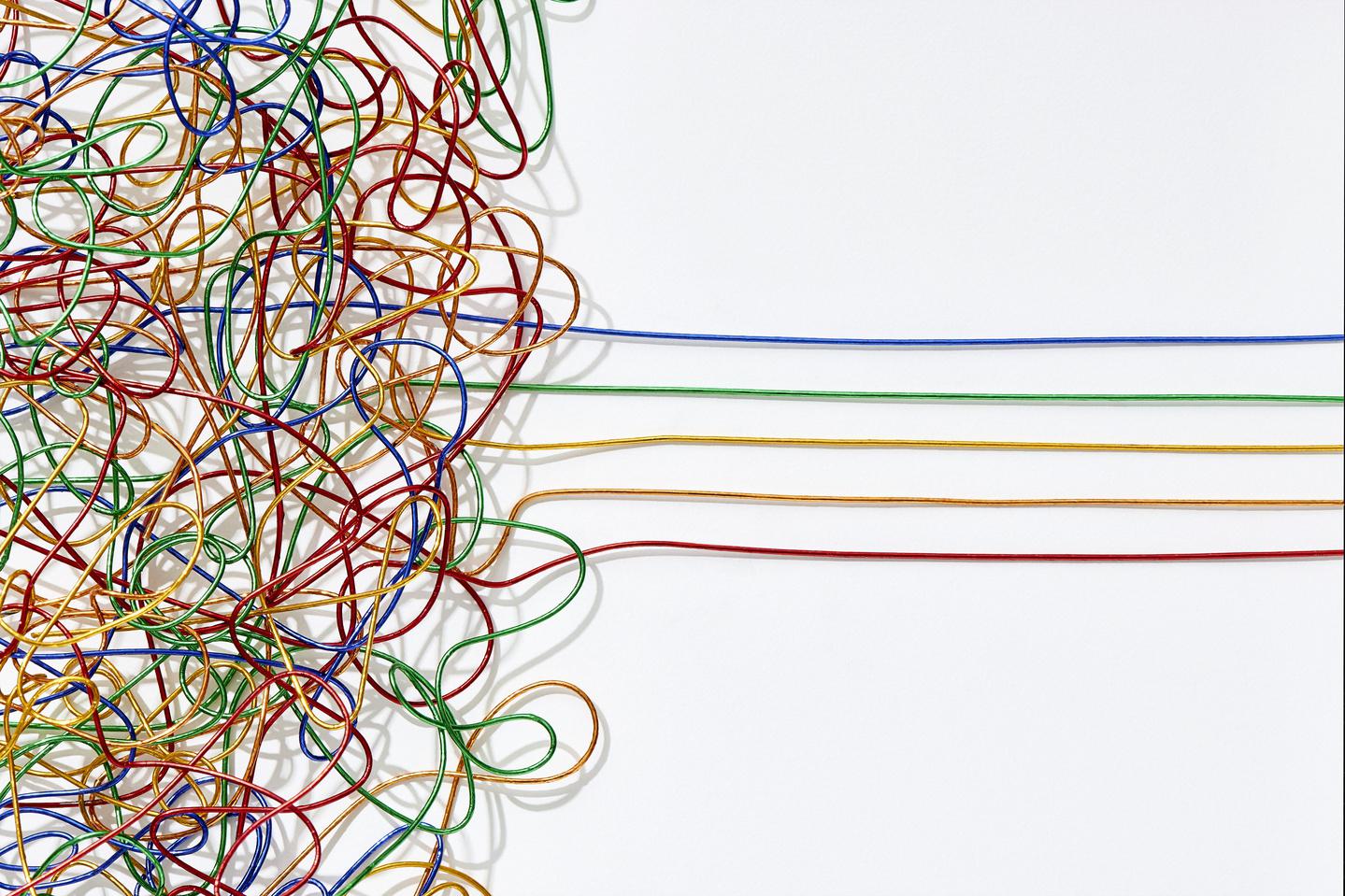

How so? Well, something that is complicated might be confusing and have a lot of moving parts, like an internal combustion engine, but ultimately it “can be broken down into a series of neat and tidy deterministic relationships.”

Using financial planning as an example, there are standard elements of financial planning—like investments, insurance, tax, estate, retirement, and education planning—that comprise a subject matter that is deep and wide, but at the same time, if you knew exactly what you wanted to accomplish, you could theorize precisely what steps should be taken within each element, even in concert with the others, that should result in a successful scenario, at least numerically speaking.

In short, there is a textbook approach to financial planning, and we can limit the practice to a complicated, but nonetheless computational, rational, logical, and therefore predictable pursuit. But financial planning isn’t just complicated…

“Complexity, on the other hand, occurs when the number of interactions between components increases dramatically—the interdependencies that allow viruses and bank runs to spread; this is where things quickly become unpredictable,” McChrystal tells us. “The reality is that small things in a complex system may have no effect or a massive one, and it is virtually impossible to know which will turn out to be the case.”

Financial planning is complex because we are complex. You and I aren’t just dollars and cents, and we often don’t even make sense—indeed, the field of behavioral economics has demonstrated we’re driven more by emotion than equation. That unpredictability is then compounded by the interdependencies of anyone and everyone else involved in the financial planning process—spouses, ex-spouses, partners, children, parents, planners, attorneys, CPAs, bosses…

It’s like in the proverbial iceberg example: What we see on the surface is the quantitative, but beneath is the vast qualitative.

But I don’t want it to sound hopelessly complex. The good news—great news—is that in better understanding ourselves, even the most complex financial planning scenarios, while not necessarily easy, can be made surprisingly simple. By knowing what’s most important in your life, it can become clear(er) what to do with your money.

That’s why the most important part of financial planning is actually life planning. That’s why even financial planners need financial planners. And that’s why true financial life planning is never a product, but a process.

Bonus: Do you want to hear what the resolution of complexity sounds like? Listen to this rendition of J. S. Bach’s Prelude to Cello Suite No. 1 in G Major. You’ll hear Yo-Yo Ma play a 300-year-old piece of music that can be boiled down to rote mathematics—but you’ll hear him push and pull, swell and subside, imbuing notes on a page with a story within a story. The song builds and builds to the point of tension before resolving to what feels like perfection. Enjoy.

© 2022 Forbes Media LLC. All Rights Reserved

Comments are closed.