Uncategorized

Fixed or variable rate mortgage? There’s a third option, but you’ll always be ‘half wrong’

Who says you cannot split the difference and diversify your debt with a hybrid mortgage?

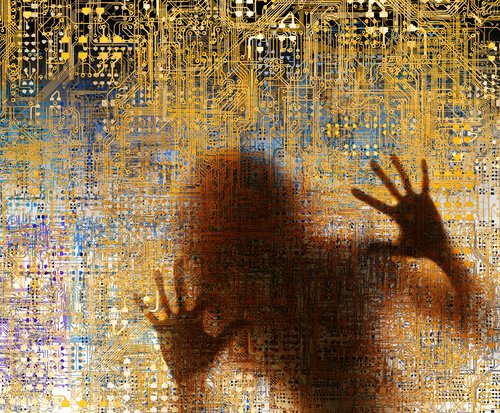

Machines like Us: AI is upending higher education. Is that a bad thing?

This isn’t just about how we teach and how we learn – it’s about the future of how we think.

Are you addicted to shopping?

On social media, it can be hard to resist the urge to splurge.

Fall Fatigue: 4 Tips So September Doesn’t Become ‘Stresstember’

Fall fatigue occurs during the gap between summer and fall, affecting your energy level, focus and engagement at work, but Forbes has tips on how to offset the malaise.

Beware the AI Experimentation Trap

AI experimentation is not broken, but it must be disciplined—focused on solving core customer problems; chosen with frameworks like intensity, frequency, and density; run at low cost to enable iteration; and designed with scaling in mind through empowered “ninja” teams.

September Effect: Definition, Stock Market History, Theories

The September Effect refers to the historically weak stock market returns observed during the month of September going back nearly a century. Howevever, in recent years, the median return for September has actually been positive. Here’s what’s behind it.

Equifax. TransUnion. Credit Karma. Here’s why your credit scores are all different — and how you can improve them

Credit agencies with different data sets and algorithms, writes Lesley-Anne Scorgie, can result in a differrent credit score from site to site.

Expert Financial Advice for Gen Z: Overcoming the Quarter-Life Crisis with Confidence

The financial struggle is real for today’s young adults. As many as three-quarters of young adults are experiencing a “quarter-life crisis.” Confronting the details of your finances is a key first step to getting past anxiety.

Why it’s crucial to include RESPs in an estate plan

If the subscriber dies, the assets in the RESP belong to their estate and not the beneficiary.

Want to keep your money safe online? Some two-factor authentication options are better than others

With sophisticated cyberattacks ever more common, online-security experts warn that some types of two-factor authentication, or 2FA, are better than others.