Here’s what to do if you’ve missed out on the massive 54% stock market rally since October 2022

Many potential investors have been on the sidelines amid a massive stock rally. Fears of a recession and Fed rate hikes kept many from buying stocks over the past year. Investors may need to embrace a bit of volatility if they want to succeed in the long term.

‘Still time to re-create myself’: Retirees returning to work seek routine, fulfilment

When 63-year-old Shaundra Oelsner retired from her finance job at Sun Life two years ago, she thought to herself, “There’s still time to re-create myself.”

How to add strength training to your existing workout routine

Here’s some great news: You can reap many of the benefits of resistance training in as little as a few weeks, with shorter workouts that fit into your current routine.

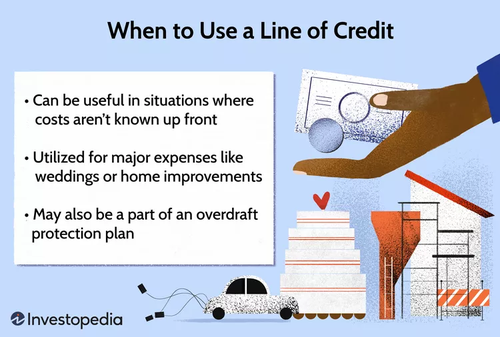

Lines of Credit: When to Use Them and When to Avoid Them

Lines of credit can provide versatility but there are risks to consider

Why Gardening Is So Good for You

Digging holes can be a workout and mood booster all rolled into one.

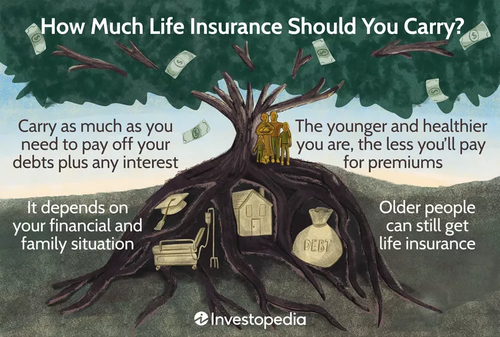

How Much Life Insurance Should You Have?

Determining coverage may depend on your financial goals and needs

Video: How much the Bank of Canada will cut in 2024

Dawn Desjardins, senior economist at Deloitte Canada, talks with Financial Post’s Larysa Harapyn about what the latest inflation data means to the Bank of Canada and interest rates.

Diego Maradona offers central bankers enduring lessons

Recent years ought to have reduced the importance of a skilful feint. They have not.

How to Rethink Your Career as an Empty Nester

As you progress through your career, you’ll no doubt encounter some major milestones and transition points that might spur you to pause and reassess the path that you’re on. One such milestone that affects working parents is becoming an empty nester.

FP Answers: Should I pay myself dividends from my company to avoid CPP premiums?

Passing on the premiums might save money today but cost you retirement income in the future.

The information provided here is for general information purposes only and is based on the opinion of the owners and writers only, subject to change without notice. It is not intended to provide specific personalized advice including, without limitation, investment, financial, legal, accounting or tax advice. Every effort has been made to compile this material from reliable sources; however, no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please contact your advisor for individual financial advice based on your personal circumstances.

The information provided here is for general information purposes only and is based on the opinion of the owners and writers only, subject to change without notice. It is not intended to provide specific personalized advice including, without limitation, investment, financial, legal, accounting or tax advice. Every effort has been made to compile this material from reliable sources; however, no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please contact your advisor for individual financial advice based on your personal circumstances.