AI has all the answers. Even the wrong ones

A computer that is capable of seeming so right yet being so wrong is a risky tool to use.

The exponential growth of solar power will change the world

An energy-rich future is within reach

Canada’s population topped 41 million. But is this the rise before the fall?

Canada’s population surpassed 41 million in April, just 10 months after it hit 40 million in June 2023.

Identify — and Develop — Your Natural Strengths

“What is your biggest weakness?” We’ve all been asked this dreaded interview question. You’re probably thinking of your canned response right now: You’re a perfectionist. You focus too much on the details. You have a hard time shutting off after work hours.

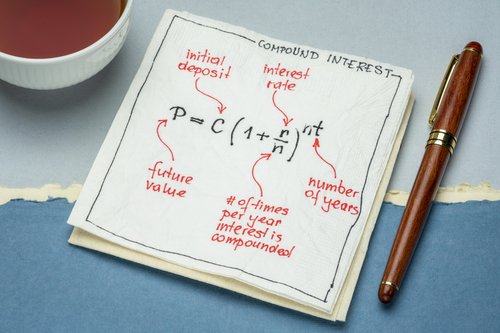

The Life-Changing Magic Of Compound Interest

Here’s everything you need to know about what Albert Einstein allegedly called the eighth wonder of the world.

Why house prices are surging once again

In America, Australia and parts of Europe, property markets have shrugged off higher interest rates

15 Money-Saving Tips That Actually Work

Saving money in today’s economy might sound like a steep challenge, but with the right tips, it is achievable.

Popular money books to add to your summer reading list

Newbie or pro, you’ll learn a trick or two with these titles, Lesley-Anne Scorgie writes.

Freeland says broad strokes of capital-gains tax hike haven’t changed, details coming Monday

In a Sunday speech at a Toronto YMCA, Freeland described the $19.4-billion revenue boost, over five years, as one that the rich can afford and that must be done to help everyone else.

Is it better to be an early bird or a night owl?

The promise and perils of waking before sunrise

The information provided here is for general information purposes only and is based on the opinion of the owners and writers only, subject to change without notice. It is not intended to provide specific personalized advice including, without limitation, investment, financial, legal, accounting or tax advice. Every effort has been made to compile this material from reliable sources; however, no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please contact your advisor for individual financial advice based on your personal circumstances.

The information provided here is for general information purposes only and is based on the opinion of the owners and writers only, subject to change without notice. It is not intended to provide specific personalized advice including, without limitation, investment, financial, legal, accounting or tax advice. Every effort has been made to compile this material from reliable sources; however, no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please contact your advisor for individual financial advice based on your personal circumstances.