TStrain

Want to invest but need ready access to cash? A TFSA might be your best bet — but there are rules

Financial planning experts say over-contributing beyond a TFSA’s annual limit is a common mistake people make and can lead to tax penalties.

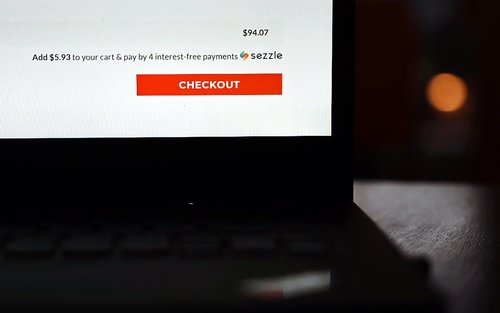

What to know before you use “buy now, pay later” in Canada

Many retailers offer buy now, pay later programs to encourage spending. Understand the risks, including how your BNPL data could affect your credit score.

Investors ignore world-changing news. Rightly

Crisis, what crisis? The momentum of markets can be relentless. Shares tend to grind higher over time as consumers spend, entrepreneurs innovate and companies grow. Earnings per share for American firms have risen by 250% or so over the past 15 years. For any event to have a meaningful impact, at least for longer than a few days, it must harm such dynamism.

Is “Money Dysmorphia” Sabotaging Your Financial Future?

Here’s how to spot it and shift your mindset.

Scammers are impersonating finance experts to steal millions – and the real ones are struggling to stop it

Fraudsters are increasingly posing as actual financial heavyweights and using AI deepfakes to target investors on social-media platforms such as WhatsApp and Facebook.

Aging in place: How to plan and prepare for staying in your home as you age

It’s not too soon to explore what age-in-place home improvements, and home-care cost options (and alternatives) are available for yourself and aging family members, Lesley-Anne Scorgie writes.

Terrible things happen in life – but it is possible to recover from them

We go to all sorts of lengths, often unconsciously, to hide from what has hurt us. But only by attuning to pain can we hope to heal.

How does Jon invest in his RRIF so he has enough cash when he must start withdrawing?

FP Answers: There are several strategies for maximizing cash flow when mandatory withdrawals start in your retirement fund.

What Canadian investors need to know about the Trump tax bill

The bill has the potential to more than double the tax applied to dividends from U.S. companies.

Trump’s tariffs have so far caused little inflation

The Economist’s estimate of their impact will be updated every month.