The uniqueness of what we’ve seen from the stock markets since the March, 2020 crash cannot be overstated.

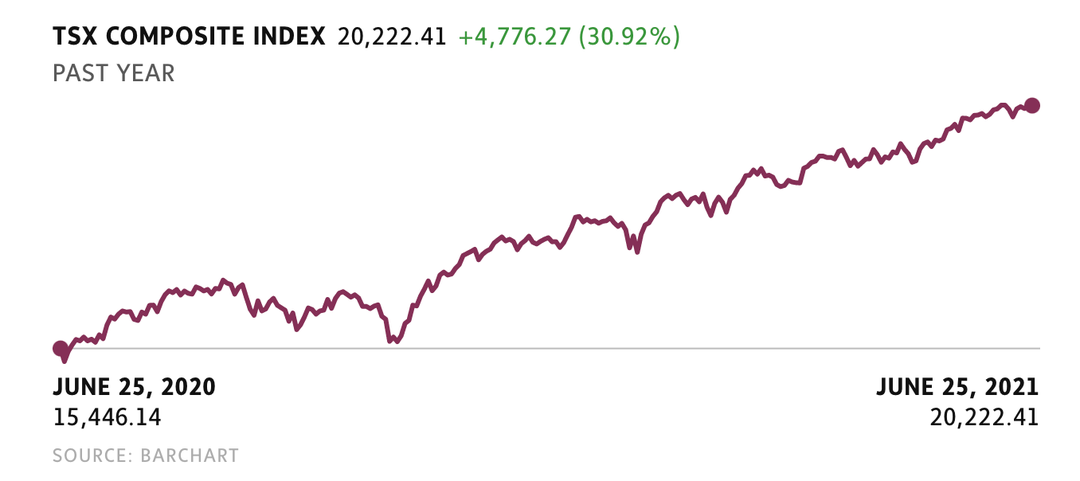

We saw a 33.8-per-cent total return from the S&P/TSX Composite Index for the 12 months to May 31; and a 38.9-per-cent gain from the S&P 500 and 42.6-per-cent gain for the Nasdaq 100, in Canadian dollars. Asked what they saw from their investments going forward, 300 Canadian investors recently said they expected returns averaging 11.2 per cent above inflation over the long term.

Inflation clocked in at 3.6 per cent in May, which means investors are looking at average annual all-in portfolio returns of 14.8 per cent. A four-word comment on this outlook: Not going to happen.

The survey of investors was conducted on behalf of an international financial firm called Natixis Investment Managers. All had at least $100,000 in household investable assets, which suggests the potential for some familiarity with investing. The reason why these investors are so optimistic about the future comes down to a phenomenon known as recency bias. In assessing future returns, investors are looking to the recent past.

Natixis says financial professionals regard 5.1 per cent on top of inflation as a realistic return, which seems somewhat optimistic as well. You might want to be more conservative in your own planning, based on the idea that the recovery from the pandemic has in large part already been priced into stocks. We could see markedly more subdued returns ahead and, at some point, a correction.

According to Natixis, Canadian investors have a track record of unrealistic expectations for market returns. However, this exuberance has become more pronounced lately. If anything, now is the time for caution. Focus on quality, even if speculative plays are still working. Focus on diversification, even if bonds are out of favour. Focus on long-term results, even if you can’t take your eyes off your spectacular recent results.

Canadian stocks produced an average total return of 7.3 per cent annually over the past 20 years, including the past year and its surge in share prices. The mini-lesson in this number is that returns never stay as good as they are in boom times and neither do they stay as bad as they look in a crash.

This Globe and Mail article was legally licensed by AdvisorStream.

Comments are closed.