Giving the perfect gift can be an art form — and a hit to your wallet.

Ideally, shopping season prep begins well before the winter months, says Thuy Lam, a certified financial planner with Objective Financial Partners in Toronto.

“If you don’t have the funds available,” says Lam, “hopefully you’ve got the cash flow, a little bit of surplus that you could set aside.”

iStock-1289616163

Deidre Cross, a Toronto-based content creator and budget expert, agrees.

Cross, whose TikTok handle is ohhyoubudget, says this can be as simple as setting aside $50 a month in a high-interest savings account for your year-end shopping spree.

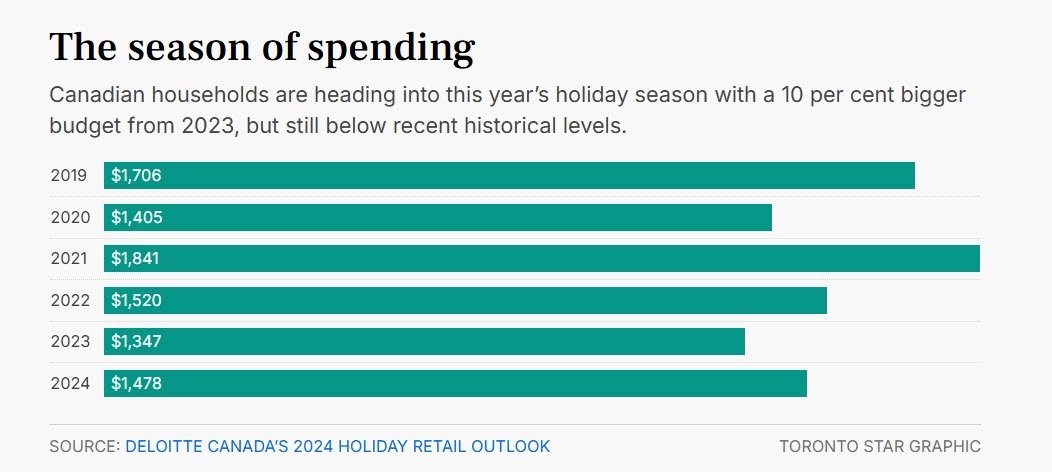

Canadians plan to spend $1,478 this holiday season, $131 more than last year, according to Deloitte Canada’s 2024 holiday shopping report. Putting aside money throughout the year can take pressure off of those year-end credit card headaches.

Didn’t set aside money throughout the year? You’re not alone.

The same Deloitte Canada report found that a third of Canadians are worried about credit card debt, with more than half concerned about how they’ll pay their mortgage or rent.

But gifting doesn’t have to be expensive. Cross recommends using loyalty points or credit card rewards for things like gift cards. She also recommends shopping for discounted gift sets or advent calendars that you can divide into several gift baskets for loved ones.

Experience-based gifts can also be just as thoughtful.

Things like cooking classes, paintball or say a yearlong pass to a favourite museum can be cheaper on a cost-per-use basis. Activities and classes are also perfect last-minute gifts because you can often buy them online.

“It’s important to take a step back and reflect on what type of experience you want to create when you think about the holiday season,” says Lam. “What’s most important to you and your family?”

Lam says to be wary of using instalment plans or Buy Now, Pay Later (BNPL) to buy your gifts.

“Depending on the combined dollar value these offers,” says Lam, “can you handle those payments?”

Lam adds that it might be tempting to take up low- or zero-interest rate offers, but to be cautious about making a late payment that could hurt your credit score.

“One of the biggest concerns is these high-interest credit cards are utilized during the holidays,” says Lam. “Holiday spending becomes much more expensive if we’re not reflecting on whether we can handle those payments … especially if we can’t afford to pay more than just the interest.”

If you can’t afford to buy gifts this year, Cross recommends having a heart-to-heart with loved ones.

Cross said that when she was in debt, she bought gifts using money that should have gone toward paying down her loans. When she told her friends that she was working to pay off debt, her friends responded with understanding.

“They’d be like, ‘Oh yeah. I need to pay off my debt, too.’”

Comments are closed.