I don’t really believe in good or bad luck. I like the words of the late business management expert Eliyahu Goldratt when he said: “Good luck is when opportunity meets preparation, while bad luck is when lack of preparation meets reality.”

If you’re a business owner in Canada today you may count yourself unlucky because the government has made a number of tax changes over the past several years which are designed to take more money from your pockets and put more in the government’s coffers. The fact is, however, that some smart preparation can make a huge difference in the amount of tax you pay.

iStock-1447984901

Today, I want talk about a problem that the majority of Canadians who own holding companies, and their executors, will face. If you understand the problem, you can take steps to fix it.

The problem

Thousands of Canadians own holding companies with assets of meaningful value. These companies might hold cash, marketable securities, real estate, or just about anything else. If you’re one of these folks, you might have ended up with your holding company because you own – or used to own – an active business. It’s common for business owners to pay excess earnings from a business to their holding companies. Those holding companies often become a source of income – a “pension plan” of sorts – for the company shareholder in retirement.

Whatever your reason for having a holding company, there can be a double tax problem that arises on your death. Specifically, as the assets in your company grow, the value of the shares you own in your company also grow. When you die, you’ll generally pay tax on the growth in value of your holding company shares because you’ll be deemed to have sold those shares at the time of your death. If you leave your shares to a surviving spouse, you can defer the tax hit until your spouse dies – but the tax bill will arrive eventually.

But the taxes aren’t done. Not only will you pay tax on any capital gain on your holding company shares when you die, but there will be tax to pay by the corporation itself when it sells those assets that have been appreciating in value. That’s two levels of tax on the same growth. Further, if the assets in the corporation are sold and the funds are then distributed out to the shareholders, there’s a third level of tax paid on the taxable dividend in this situation. These three levels of tax are all applied on the same value that has accumulated in your holding company.

We call this the double-tax problem because, if you fail to prepare for it, the total taxes paid can be a little more than double what they might be otherwise.

The example

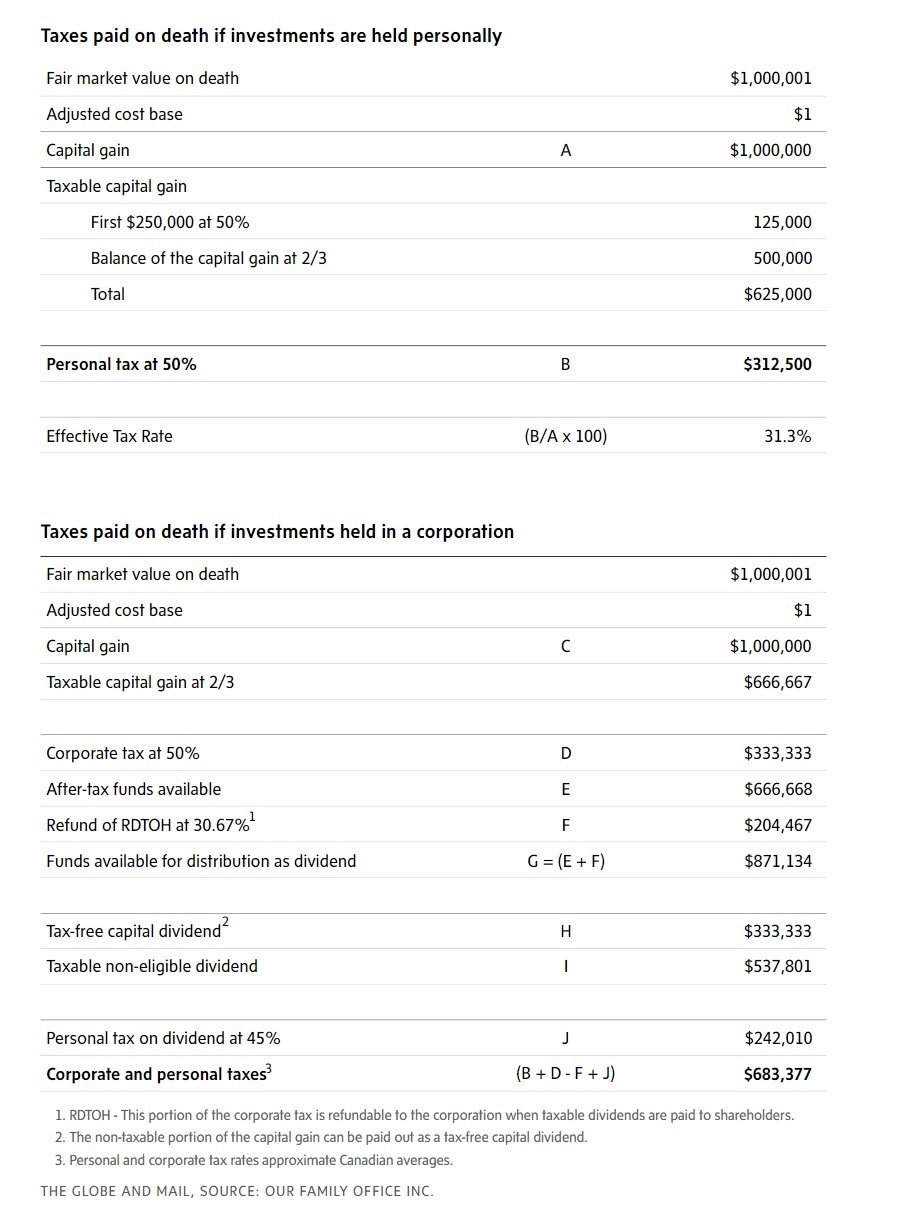

Consider Wendy, who owns $1-million worth of investments within her holding company. We’ll assume an adjusted cost base of $1 (on both her investments and her holding company shares) to make the math easier to understand. If she owned the investments personally and then died, she’d pay taxes of $312,500 at a marginal tax rate of 50 per cent (see the table). This takes into account the new capital gains tax rates that came into effect on June 25, 2024. (As an aside, the tax bill would have been $250,000 in this case under the old rules.)

Wendy, however, owns her investments inside her holding company. When she dies, there could be total corporate and personal taxes owing of $683,377 – more than double than if she owned the investments personally. How so? Well, she’ll pay taxes of $312,500 on her holding company shares on her death, plus net corporate taxes of $128,866 ($333,333 less $204,467 of taxes refunded to the corporation; see the table) when the company eventually sells its investments, plus another $242,010 owing personally when the after-tax proceeds are eventually paid out of the company to Wendy’s heirs.

The good news? There are steps shareholders can take to plan for the double-tax problem, which I’ll share next time.

© Copyright 2024 The Globe and Mail Inc. All rights reserved.

Comments are closed.