With the COVID pandemic largely behind us, there has been a small change in the Canada Revenue Agency rules on how Canadians can claim their work-from-home expenses this tax season.

The CRA discontinued the flat-rate method of claiming work-from-home expenses for the 2023 tax year.

iStock-1314080931

Introduced in 2020, the temporary flat-rate method allowed eligible workers to deduct $2 for each day they worked out of their home during the tax year because of the pandemic, up to a maximum of $500.

While the temporary flat-rate method was used to deduct work-from-home expenses in 2020, 2021 and 2022, it no longer applies for the 2023 tax year.

“With so many Canadians working from home full time during the pandemic, this was just a really easy way to do it,” says Ian Calvert, vice-president and principal at HighView Financial Group.

‘It was meant to provide administrative relief’

Arif Amjad, associate partner at SRJ Chartered Accountants, agrees. “It was meant to provide administrative relief during a time when a lot of people were working from home.”

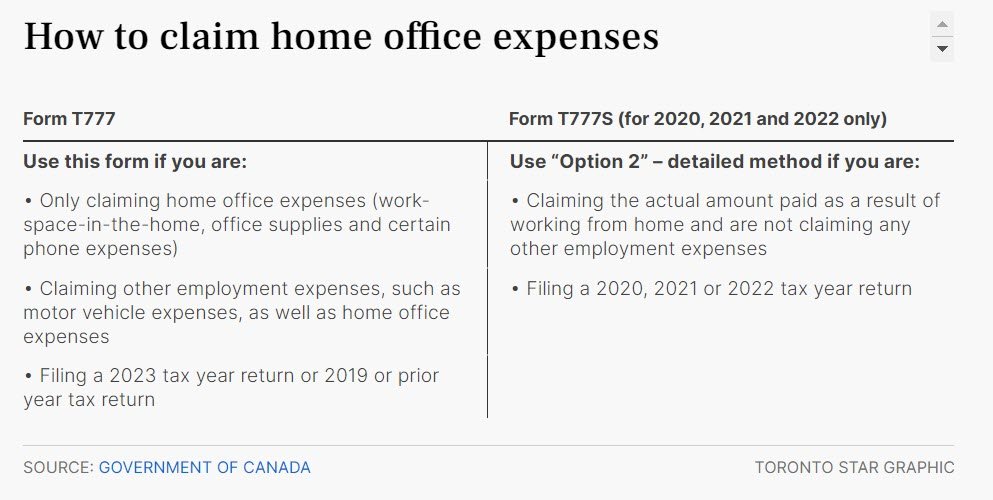

But for the 2023 tax year, the change introduced by the CRA means that companies will be providing workers with a regular T2200 form rather than the short-form version of T2200, or T2200S.

Form T2200, officially known as the “Declaration of Conditions of Employment,” is used to deduct certain work-from-home related expenses.

According to the Government of Canada website, some of the expenses salaried and commission employees can claim include electricity, heat, home internet access and utilities.

Meanwhile, expenses you can’t claim include principal mortgage payments, interest on your mortgage, furniture and capital expenses such as replacing the windows or flooring in your home.

As an employee, you don’t need to fill out the T2200 by yourself, as your company will be responsible for completing it.

Tax filers will need to keep more thorough records

Eligible Canadians will need their employer to approve eligible expenses to be deducted.

Even though your employer is responsible for this form, Calvert and Amjad say you should retain a copy of the completed form for your own records in case the CRA ever asks for it.

“The simplified flat-rate method that was rolled out the last three years really did make it easy for a lot of Canadians as we all shifted to working from home during the pandemic,” says Calvert.

But moving forward he says tax filers will need to keep more thorough records of deductible expenses throughout the year. He also acknowledges that it takes a lot of work to track items like utilities and other home expenses.

If you’re running a lot of these receipts through a bank account, Calvert says you can export the expenses to an Excel file and calculate your annual totals that way.

“Other than that, there’s the old route of keeping receipts and stuff in a file as well. You need to ensure that you’re keeping records of all these items all year.”

Comments are closed.