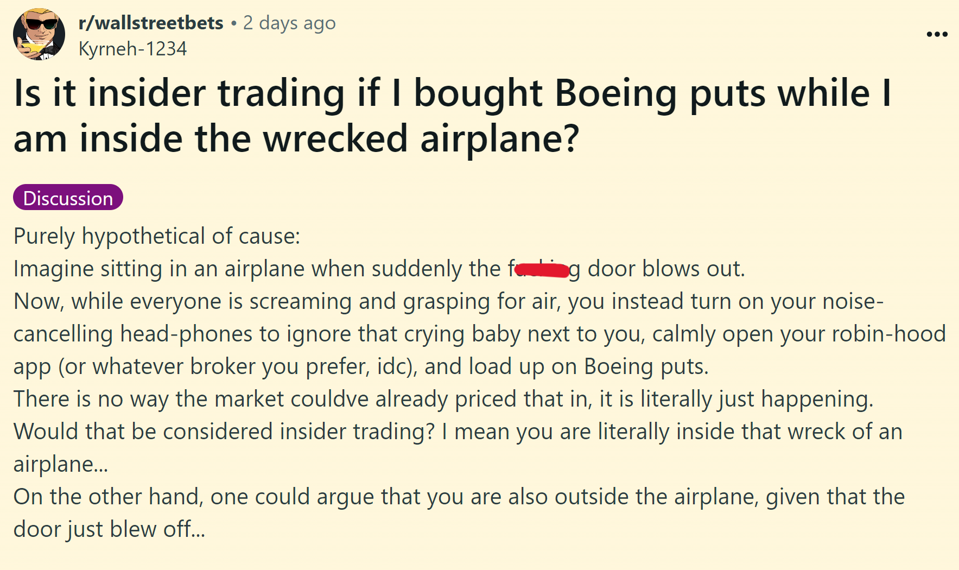

As a financial educator who is a lawyer by training, I’m always looking for attention-grabbing scenarios that provide teachable moments on technical topics. An unusual example comes from the recent incident, widely reported in the news, in which a door panel blew off a Boeing 737 Max 9 in mid-air. The creative question below, posted to the Reddit discussion forum wallstreetbets, caught my attention:

A strange but interesting question

Screenshot from Reddit.com

While it seems far-fetched that an airline passenger’s first thought in this situation would be stock trading, the question remains: Would it be illegal insider trading to trade Boeing securities (which includes buying puts or calls) while you’re on a damaged Boeing airliner before the news has been reported and thus made public? After all, you know that the incident will drive down the company’s stock price. But at the time only you, the other passengers, and the crew know about the incident. Independently, you easily connect the dots that this accident will impact Boeing’s share price.

Would it be insider trading to trade Boeing stock while you’re on a damaged Boeing airliner?

GETTY

What Is Insider Trading?

Insider trading occurs when you trade a company’s stock or other securities (e.g. put and call options) while knowing what is termed material nonpublic information (MNPI) about the company. MNPI is confidential knowledge that will affect the company’s stock price either positively or negatively when it is publicly disclosed. MNPI can, for example, be obtained during your work. Public companies have clear policies and procedures to try to prevent insider trading among their employees and executives. These include blackout and window periods for when these insiders can or cannot trade the company’s stock.

A related behavior known as insider tipping, i.e. sharing MNPI with others, is also illegal. It means telling someone MNPI about a public company which leads that person to trade the company’s securities. Many insider-trading charges have been brought against friends or family members of company insiders who, whether carelessly or deviously, tipped MNPI to them.

Pursuing insider-trading violations has long been a high priority of the US Securities and Exchange Commission (SEC), which can bring civil enforcement actions with big financial penalties against violators, and the US Department of Justice (DOJ), which can bring criminal charges.

Rules Apply To Everyone

The insider-trading laws apply to everyone, not just to executives and other company insiders. Moreover, the laws apply to MNPI not only about a company you work for but also about any company you may know through a professional or personal relationship, e.g. a vendor, client, or competitor of your employer, or from a family member or friend affiliated with that company.

Gray Areas Of Insider Trading

Insider-trading law has grown extensively out of the general antifraud provision of Rule 10b-5 in the famous Securities Exchange Act of 1934. It has evolved mostly from court interpretations as the SEC tests the edges of Rule 10b-5. The SEC and prosecutors continue to develop legal theories to reach anyone who trades on a company’s misused MNPI. These include the “misappropriation” and “temporary insider” theories.

One high-profile example is an insider-trading case in 2016 involving professional golfer Phil Mickelson and a corporate director (see the related SEC public statement ). It shows that when the SEC finds insider trading somewhere in a chain of events, all who profited will be forced to pay back their gains, even if they did not know that the information in question was tainted. In the SEC’s action, Mr. Mickelson was named as a “relief defendant,” i.e. an individual who must turn over ill-gotten gains arising from schemes perpetrated by others.

Even the definition of confidential material information is expanding beyond just straightforward good news (e.g. mergers, financials better than expected, new products ahead of schedule) and bad news (e.g. poor earnings, dividend cuts, FDA denies drug approval). The SEC often brings cases of all sizes to probe the edges of the law’s reach. Sometimes it is successful; sometimes it is not.

Over the years, the SEC and the DOJ have also looked for insider trading as it has adapted in novel circumstances. For example, see another of my articles at Forbes.com for examples of SEC and DOJ charges of insider trading stemming from the the Covid-19 pandemic: Insider-Trading Horror Stories: The Covid-19 Files .

Recently the SEC has yet again pushed the boundaries by bringing insider-trading enforcement actions for what it calls “shadow trading.” This is when you learn material nonpublic information about your company that you believe will also impact the stock price of another public company and then trade in the other company’s stock .

In 2021, the SEC filed a complaint ( SEC v. Panuwat ) in a California federal court that tests this legal theory. The SEC claims that the defendant misappropriated confidential information about his employer, Medivation, when he learned that the company was an acquisition target of Pfizer. Rather than buying his company’s stock, the defendant purchased options in a competitor company “whose value he anticipated would materially increase when the Medivation acquisition announcement became public,” the SEC alleges. The stock of that competitor did increase by 8% after the acquisition’s announcement.

The Boeing Situation

As those examples show, the SEC is not shy in hunting for insider trading in novel circumstances. But what about potential insider trading in Boeing stock on a damaged Boeing airliner in mid-flight? That’s about as novel as circumstances can be.

In my opinion, the hypothetical situation presented by the Reddit post would probably not be insider trading, assuming the passenger is just an airline customer with no connection to Boeing or any supplier of the defective part—also assuming the passenger did not cause the fuselage blowout (in which case the insider-trading charges would be the least of their worries).

The reason for my opinion is that insider trading/tipping arises when the trader or tipper has a fiduciary duty or relationship to the company whose stock is traded. To commit insider trading, the person would have to be an employee, contractor, vendor, executive, or director of the company with inside knowledge of the plane’s defect, or have a contractual agreement not to use what they learn as a customer for their personal benefit; or a passenger without any Boeing connection would need to have been given (i.e. tipped) the information by, or have stolen it from, any of those types of individuals with a fiduciary relationship to the company.

An airline passenger without any of these connections would not be committing insider trading. The knowledge of the aircraft accident fell out of the clear blue sky, so to speak. This person can use the information gained in mid-flight as the reason to purchase Boeing put options or sell stock before the news goes public.

Try To Avoid Being An SEC Test Case

Nevertheless, as the examples I mentioned earlier show, the SEC likes to test the borders of insider-trading law. Even if you’re acquitted or not formally charged, being the focus of an SEC investigation is costly, embarrassing, and stressful. Therefore, even if you have no link to a company and its stock, it is best to seek legal counsel before trading its securities while knowing information you come across that has not yet been reported or released to the public.

Abundant resources on insider-trading law and prevention are available at the website myStockOptions.com (see the section SEC Law), including an interactive quiz to help you stay out of trouble.

© 2024 Forbes Media LLC. All Rights Reserved

Comments are closed.