Weaker-than-expected second-quarter gross domestic product data this morning have money markets pricing in stronger odds that the Bank of Canada is done with hiking rates for this economic cycle.

Canada’s economy unexpectedly contracted in the second quarter at an annualized rate of 0.2%, while real GDP was most likely unchanged in July after a 0.2% fall in June, Statistics Canada said.

iStock image

The second-quarter reading was far lower than the Bank of Canada’s forecast for a 1.5% annualized GDP growth as well as the 1.2% gain expected by analysts.

The quarterly slowdown was largely due to declines in housing investment, smaller inventory accumulation, as well as slower international exports and household spending, Statistics Canada said.

The month-over-month decline in June was in line with forecasts. Statscan also downwardly revised May GDP growth to a 0.2% increase from an initial report of 0.3% growth. First-quarter annualized growth rate was also downwardly revised to 2.6% from 3.1%.

Friday’s GDP report is the last major piece of domestic data before the Bank of Canada makes its next policy decision next week.

Credit markets have quickly reassessed the odds that the bank will further hike interest rates at next week’s meeting and they are now signalling very strong odds – about 91% – that the BoC will hold rates steady, according to Refinitiv Eikon data that’s based on implied probabilities in the swaps market. That’s up from about 79% odds of no change prior to the 0830 am ET GDP release.

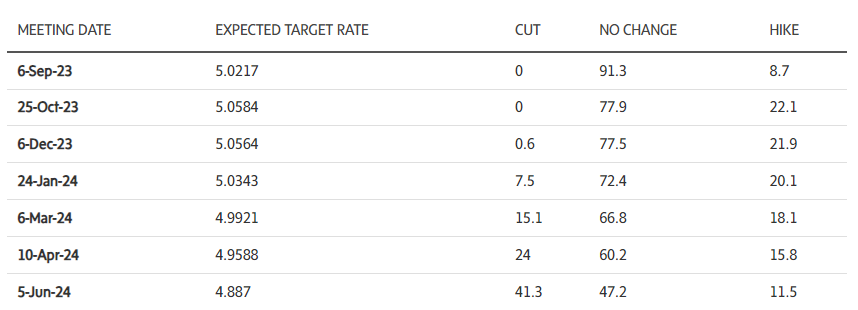

The following table details how money markets are pricing in further moves in the Bank of Canada overnight rate, as of 0840 am ET. The current Bank of Canada overnight rate is 5%. While the bank moves in quarter point increments, credit market implied rates fluctuate more fluidly and are constantly changing. Columns to the right are percentage probabilities of future rate moves.

Beyond the September meeting, money markets are also now pricing in much stronger odds that the bank won’t hike rates any further through the course of this year and next. By next June, money markets are now pricing in nearly 50% odds that the bank would have implemented a rate cut.

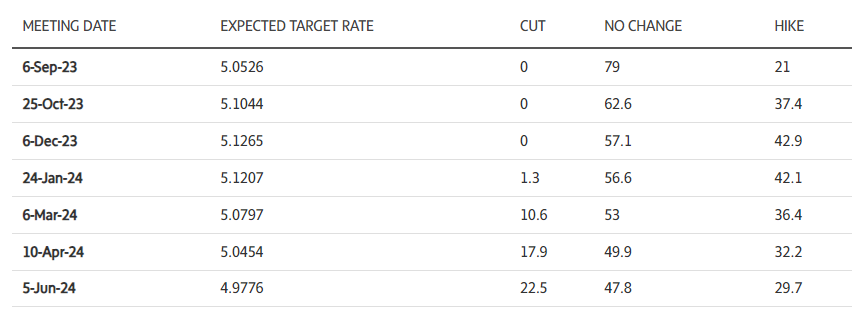

Here’s how the swaps pricing looked just prior to the 8:30 a.m. ET GDP report:

The U.S. released its nonfarm payrolls report simultaneously, and it too pointed towards a slowing economy. The unemployment rate jumped to 3.8% last month, from 3.5% previously. Employers added 187,000 workers to their payrolls last month, more than they did in July, though revisions showed job growth in the prior months was not as strong as first reported.

That report had money markets betting that the U.S. Federal Reserve is also done with hiking interest rates. Futures that settle to the Fed’s policy rate now reflect the chance of U.S. central bankers tightening policy any further this year dropping to about 38% from about a 45% chance seen before the latest jobs report.

The Canadian dollar is down about half a cent against the greenback in the wake of this morning’s economic reports. The Canadian two-year bond yield – sensitive to changes in Bank of Canada policy – is down about four basis points to 4.60%. The U.S bond yield of the same tenure is nearly unchanged.

Here’s how economists are reacting to Friday’s Canadian GDP report:

Stephen Brown, deputy chief North America economist, Capital Economics

The surprise contraction in second-quarter GDP leaves little doubt that the Bank of Canada will keep interest rates unchanged next week. With the fall in monthly GDP in June and the apparent stagnation in July setting a weak foundation for the third quarter, the Canadian economy may already have fallen into a modest recession. …

Compared to our forecasts, the biggest downward surprises stemmed from the fact that consumer spending only inched up by 0.2% annualised despite the boost from ongoing rapid population growth. That suggests interest rates are weighing even more heavily than we thought. Due to the recent rises in home sales and housing starts, we also assumed a small rise in residential investment, but it instead slumped by a further 8.2% annualized – likely reflecting a large decline in renovations investment. …

The challenge now is determining how much of the weakness in the second quarter was due to temporary factors. In the GDP by industry press release, Stats Can noted that the wildfires in May and June weighed heavily on the agriculture and forestry sectors and was a small drag on the mining, oil & gas sector last quarter. While that leaves scope for activity in those sectors to eventually rebound, there was no sign of that in July with the latest preliminary estimate pointing to unchanged GDP. GDP now needs to rise by 0.1% m/m in both August and September to avoid another quarterly contraction. Given the ongoing disruption from the wildfires in August and the weakness of some of the surveys, we remain confident in our forecast that quarterly GDP will edge down again.

Douglas Porter, chief economist with BMO Capital Markets

The small pullback in Q2 GDP lines up well with the recent rise in the unemployment rate, and reinforces the point that growth is cooling markedly, even when looking through the many special factors in recent months. … We are sticking to our view that Canada will experience a mild contraction, and today’s surprisingly soft Q2 obviously makes that outcome much more likely. The broad softening in the domestic economy will almost certainly move the BoC to the sidelines at next week’s rate decision after back-to-back hikes. Between the half-point rise in the unemployment rate, the marked slowing in GDP, and some cooling in core inflation, it now looks like rate hikes are over and done. Now, the Bank of Canada just has to be patient as they wait for inflation to come their way—but that could take some time, especially with oil prices backing up again.

David Rosenberg, economist and founder of Rosenberg Research

It could well be that current quarter real GDP growth will come close to stagnating and remember that the Bank of Canada’s prediction was +1.5% for both Q2 and Q3 in its most recent published forecast. Unless Tiff Macklem and his policy group believe the supply side of the Canadian economy is contracting, the GDP data clearly show that a disinflationary output gap is in the process of reappearing and with that, a likely shift back to the sidelines for the central bank. With the Canadian economy, even with the immigration boom, clearly underperforming the U.S., there is going to be added negative fallout for the Canadian dollar and its nickname of being the “loonie” will be well deserved (as in — a flightless bird).

James Orlando, director and senior economist, TD Economics

So much for that overheating economy. While Canada’s economy was widely expected to slow in the second quarter of 2023, today’s report came well under expectations. … While federal government transfers in July may result in a short-term boost in the third quarter, we believe Canada has entered a stage of below trend economic growth. This should continue through the rest of this year, as the impact of high interest rates work through the economy to prevent another acceleration in demand.

When the Bank of Canada decided to raise rates in June and July, it did so largely because consumer momentum was so strong in the first quarter of 2023. But with today’s weak report and with employment growth decelerating to a 12k pace (three-month average), from 80k in the first quarter, consumer demand should continue to act as a weight on growth. This cooling off is exactly what the BoC wants to see in order to be confident that inflation will keep pushing towards the 2% target. We think it will continue, justifying our call for the BoC to remain on the sidelines for the rest of this year.

Matthieu Arseneau and Alexandra Ducharme, economists with National Bank Financial

This morning’s data is much weaker than the previously released monthly GDP figures, and therefore well below economists’ expectations. Adding to the disappointment, Q1 growth was revised down by 5 tenths of a percent (from 3.1% to 2.6%). This means the economy is much less overheated than the Bank of Canada believed in July (Q2 expected at 1.5% vs actual at -0.2%). Under normal circumstances, a quarter of stagnation like Q2 would not necessarily be a cause for concern. But there’s nothing normal about the current situation, as population growth is booming. Taking this factor into account, real GDP per capita actually fell sharply in Q2 at an annualized rate of 3.1%, the fourth consecutive quarterly decline, coinciding with the start of the central bank’s monetary tightening. For the 4 quarters to Q2 2023, GDP per capita is down 2.0%. If you’re wondering how many times this has happened historically, it occurred 4 times in the last 4 recessions. In each episode, when GDP per capita was barely below the previous year’s level, the central bank was already in easing mode, in contrast to the current hawkish stance of the Bank of Canada.

Further evidence that the economy has been growing well below potential of late is the sharp rise in the unemployment rate, which jumped five-tenths of a percent in just four months. Given the trend in profits and investment over the past 4 quarters, there is every reason to believe that corporate appetite for hiring will be very weak and may even mean job losses in some cases. The rise in employee compensation since the beginning of the year (+8% annualized) is simply incompatible with the fall in corporate profits (-26%), and this could mean difficult decisions for companies. According to the latest CFIB survey, concerns about weak domestic demand rose sharply in August, which is far from a sign of a stronger economy in Q3. Moreover, the preliminary estimate for July, which points to a stagnant economy, is also worrisome given that this is the month when many households received their food rebate from the federal government. Given that monetary policy is the most restrictive of the G7 countries in real terms, we do not believe that this weakness is temporary, and we continue to expect economic lethargy over the next 12 months.

Katherine Judge, economist with CIBC Capital Markets

Forest fires may be taking a few decimal places off the data, but the Canadian economy is hardly on fire in terms of growth, casting doubts on claims that it can shrug off the impact of higher interest rates. After what looks like a one quarter flash in the pan, GDP contracted in the second quarter, making the last rate hike seem like overkill, and virtually ruling [out] a further hike next week. … A sharp drop in housing investment compounded slower inventory investment and sluggish export growth, while consumption growth slowed to 0.2% annualized, with the first quarter’s spending spree now looking like a-one off amidst tame readings in three of the last four quarters. So much for the consumer resilience that the BoC had cited as a reason to press on with still-higher rates.

The decline in housing investment was somewhat surprising given the pickup seen in unit home sales, but it reflected a drop in new construction and renovation activities. Weaker construction isn’t of course great news for inflation in housing, but the general slowing in activity and labour markets should, overall, still be disinflationary. The other big negative for the quarter was slower inventory investment amidst bloated inventories relative to the pace of sales in the economy, a result of flagging demand for goods. It’s not just domestic consumer demand that is flagging, as goods exports fell by 2.1% annualized. Some of that likely reflected disruptions to energy production due to fires in Alberta, but global growth prospects look soft enough at this point to suggest that trade won’t help much from here.

The deterioration in consumption will likely prevent any further hikes from the BoC from here. The third quarter also looks to be off to a weak start, and should contribute to the trend towards more labour market slack, a key ingredient in quelling domestically-fueled inflation ahead.

Derek Holt, vice-president and head of Capital Markets Economics, Scotiabank

The common narrative is that [the GDP data} provide evidence that Canada’s economy has finally buckled under the weight of rate hikes. That’s thin veneer headline commentary in my view. The underlying details point to something that is considerably more robust when controlling for various distortions like the very widespread impact of wildfires, strikes and probably weather as well. …

The Bank of Canada has the cover in the GDP data to stay on pause with a hawkish bias on Wednesday. That’s because growth came in materially weaker than they had forecast. … It’s also because the BoC is likely to lean in favour of going through a full forecast process into the October MPR and evaluate further incoming data between now and then and beyond. They will want to delve deeply into the figures and drivers in order to develop an updated view on how much of the softness may be transitory. I think a lot of it is, but I’d like to see what their army of economists and policymakers think. For now, the BoC must leave the door open to returning with future tightening on the statement bias for three reasons.

- One is that I think this set of numbers has transitory written all over it and we’ll probably see signs of a firm rebound into year-end as a multitude of shocks wears off.

- Two is that the BoC needs to manage markets and keep at bay itchy trigger fingers that are inclined to pounce on rate cut pricing prematurely. The usual line here is that history cautions strongly against prematurely declaring victory over inflation and particularly in today’s world of widespread structural changes.

- Three is that the BoC has been clear that it is focused upon the multiple influences upon core inflation, inflation expectations, wages, productivity and corporate pricing behaviour. Governor Macklem has also said he needs to see demand growth slow and today’s numbers are a step in that direction, but not if we just wind up rebounding from temporary drag effects.

Nathan Janzen, assistant chief economist, RBC Economics

The GDP data should reinforce expectations that the BoC will move back to the sidelines and forego another interest hike next week. The BoC won’t put too much emphasis on one piece of data, and inflation is still ‘stickier’ at above-target rates than they would like. But evidence is building that the lagged impact of earlier rate hikes are beginning to work more significantly to cool GDP growth and labour markets, and that should mean inflation pressures will continue to gradually slow. Policymakers will want to leave the door open to re-starting hikes again down the road if necessary. But if the unemployment rate continues to drift higher, as we expect, a re-start won’t be necessary.

Philip Petursson, chief investment strategist at IG Wealth Management

There wasn’t much to like in the report, and much that disappointed. Household final consumption came in much weaker than the prior quarter, while residential investment continued along its negative contribution trend. Most of the weakness in the report came on the back of the consumer. The results here are an indication of the impact of the higher interest rate environment on Canadian consumers. Regardless, two out of the last three quarters have now shown negative GDP growth on an annualized basis. In our mind this sets up a clear pause for the Bank of Canada next week. In fact, if this report is reflective of the near-term trend, which we believe it is, the Bank of Canada has reached the end of this tightening cycle.

Bryan Yu, chief economist, Central 1 (credit union)

This is the last key data release heading into the Bank of Canada’s September interest rate decision and the miss should prove highly influential in keeping the Bank on the sidelines as it adds to a signs of slowing core inflation, a softening labour market and weaker consumer demand. We expect the Bank to hold until the end of Q1 2024 when it commences rate cuts.

Comments are closed.