Canada’s annual inflation rate dropped to 4.3% in March, matching expectations, as a drop in energy prices helped to keep the consumer price index in check despite a record rise in mortgage costs. Month-over-month, the consumer price index was up 0.5%, again matching forecasts.

Prices of store-bought food also slowed to 9.7% in March, falling below 10% for the first time in 8 months. Excluding food and energy, prices rose 4.5% compared with a rise of 4.8% in February.

The Canadian dollar and bond yields held steady following the 830 am ET inflation report that didn’t contain any big surprises.

iStock-1347890491

But the still-elevated levels of inflation, which was highlighted as an area of concern by a still hawkish-sounding Bank of Canada last week, have money markets now predicting slim odds that the central bank will start cutting interest rates anytime this year.

Interest rate probabilities, based on trading in swaps markets, were pricing in a 25 basis point cut by this December in the overnight rate just a week ago – and 50 basis points of monetary easing two weeks ago.

Now, markets have pushed forward their expectations for when rates will decline into next year. They have even priced in slight odds of a further rate hike at some point this year.

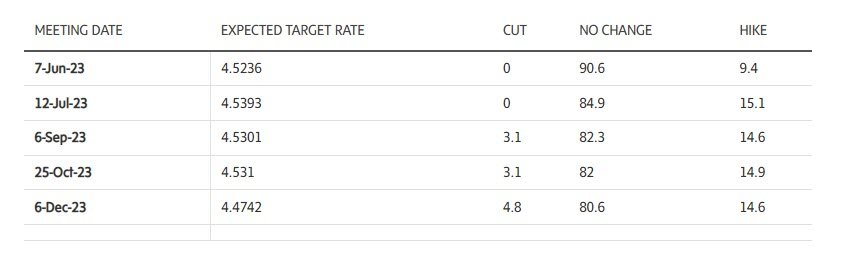

Here’s how money markets are pricing in further moves in the Bank of Canada overnight rate for this year as of 9 a.m. ET, according to Refinitiv Eikon data. The current Bank of Canada overnight rate is 4.5%. While the bank moves in quarter point increments, credit market implied rates fluctuate more fluidly and are constantly changing.

As illustrated, money markets see greater than 80% odds of no changes to the bank’s overnight rate for the remainder of this year. But it now sees greater probabilities that there will be a hike rather than a cut.

Interest rate probabilities take their direction from both domestic and global economic conditions. In recent days, markets have been pricing in greater odds of a further quarter-point rate hike by the U.S. Federal Reserve later this spring. Those bets have exerted some influence on where money markets are predicting the Bank of Canada’s overnight rate will be as the year plays out.

Here are excerpts from research notes today on how economists are reacting:

Royce Mendes, managing director & head of macro strategy, Desjardins Securities

Inflation hasn’t been running this slow since 2021, but that’s still not enough to satisfy Canadian central bankers who are laser focused on returning price growth to its 2% target. … The slowdown in the year-over-year rate was the result of base effects, with a very large monthly increase falling out of the annual calculation. …

While Canadian households can’t look forward to broad-based price declines, there are growing signs that the pace of price growth is settling down. The deceleration in various measures of core inflation confirm that there hasn’t been any second wave of the inflation disease. That said, price pressures still haven’t cooled nearly enough for the Bank of Canada to declare its mission accomplished and there are risks from upcoming wage negotiations. Look for central bankers to continue to threaten higher rates if the economy and inflation don’t behave.

Markets are no longer pricing in rate cuts in Canada this year and have opened the door to further hikes in the near term. However, with the recent global banking system stresses unexpectedly tightening financial conditions, we think rate hikes are now a thing of the past and cuts will begin around the turn of the year.

Derek Holt, vice-president, Scotiabank Economics

Canadian core inflation remains sticky and persistently above the BoC’s 2% headline target with no evidence of continued progress. …

The year-over-year rate of inflation cooled to 4.3% from 5.2% but is largely irrelevant in terms of evaluating monetary policy risks. … In order to evaluate price pressures at the margin—and hence not influenced by base effects—we need to use the highest frequency measures. Using year-over-year risks repeating one of the mistakes that the BoC and Fed made when inflation was first starting to take off and they dismissed it as a base effect argument while ignoring incremental pressures. Today presents the opposite risk of misjudging inflation’s decline as year-over-year rates continue to plunge over the duration of the year with uncertain effects beyond.

Hence the focus upon trimmed mean at 3% m/m SAAR [seasonally adjusted annual rate], weighted median (3.6% m/m SAAR) and CPI ex-food and energy (3.3% m/m SAAR). ….

I think that several forward-looking drivers of inflation are likely to become more heated and this may very well require additional policy tightening lest inflation expectations never come fully under control around the BoC’s desired levels. They include:

- Evidence that housing is bottoming. Canada is likely to achieve a bottom for housing’s influence on CPI earlier than elsewhere because of the way Canada captures house prices in CPI by using replacement costs derived from new home prices. This contrasts with the US in which market rent changes driving lagging influences upon owners equivalent rent.

- This view toward housing is driven by very tight housing inventories and soaring immigration. Governor Macklem is too dismissive toward the impact that immigration may have on inflation by assuming that it impacts supply and demand simultaneously. It does not. When has it ever?? Especially in Canada, where a demand infusion always arrives before supply gets added in lagging fashion. If Canada sticks with its half-million per year immigration target then it faces the likelihood of serial upward pressure upon house prices as supply persistently lags demand. There may be concomitant social challenges as well. …

- With firmer housing demand and prices may come spillover effects onto other parts of the CPI basket. If you’ve ever bought a home, new or resale, then you’d know what I mean by that!

- Canada’s job market is very tight and it is generating wage pressures that are far in excess of productivity gains with the latter being a national embarrassment throughout the pandemic.

- Public sector wage gains risk fanning private wage gains and with spillover effects into core CPI. …

Andrew Grantham, executive director, Economics, CIBC

Canadian inflation continued a steep descent in March, with that flight path likely to continue for a few more months as some of the largest monthly price increases of 2022 drop out of the year-over-year calculation. However, with core measures remaining above the 2% target, the Bank of Canada will still be concerned as to where the ultimate landing spot for inflation will be. As such, policymakers will likely maintain a hawkish tone for now, with interest rate cuts not in the cards until early next year. …

While food price inflation slowed, prices continued to rise on a month-to-month basis which is in slight contrast to the US figures last week. Core measures of inflation continued to show slower trends than those seen in mid-2022, albeit ones still inconsistent with the Bank of Canada’s 2% inflation target. The Bank’s preferred CPI-median and CPI-trim posted increases of 3.6% and 3.3% respectively on a 3-month annualized basis. Seasonally adjusted CPI ex food/energy rose by 0.3% m/m, albeit with mortgage interest costs playing a big role which is something policymakers should look past in making interest rate decisions.

Leslie Preston, managing director & senior economist, TD Economics

Inflation continued to move in the right direction in March, supporting the Bank of Canada’s stand pat rate decision last week. … We expect core inflation to continue to decelerate below 3% y/y in the second half of the year, as does the Bank of Canada.

However, the persistently high level of demand-sensitive services inflation, or “supercore”, speaks to the challenge Governor Macklem talked about last week in bringing inflation all the way back to 2%. This suggests that the BoC needs to remain vigilant to inflation pressures, and may need to hike again if momentum in the domestic economy does not cool as expected.

Douglas Porter, chief economist, BMO Capital Markets

Today’s report shows that all roads do indeed point to 3% inflation in the months ahead, with most short-term underlying metrics settling into the low-3% range. The key question for policymakers and markets is whether a 4.5% policy rate is acceptably restrictive give those inflation trends? We and the Bank of Canada believe so, but the BoC will need to be patient at that level to push inflation back into the target zone below 3%. Overall, there’s thus not much here to change the near-term outlook for policy. The Bank remains on hold, with a bias to tighten further if necessary.

Stephen Brown, deputy chief North America economist, Capital Economics

While base effects helped to pull headline inflation sharply lower in March, there were also some encouraging signs in core inflation, as the average three-month annualised gain in CPI-trim and CPI-median fell to a 16-month low. We continue to expect headline inflation to fall faster than the Bank of Canada expects this year.

Much of the decline in headline inflation to 4.3%, from 5.2%, reflected favourable base effects following the 1.0% m/m jump in prices last March. Nevertheless, it was still encouraging that prices rose by just 0.1% m/m in seasonally adjusted terms for the second month running. Although gasoline prices edged up, base effects caused energy inflation to sink to -6.9%, from 0.7%. Despite the rise in gasoline prices, overall transportation prices fell by 0.6% m/m, suggesting that airfares and vehicle prices continued to ease. Elsewhere, following a 0.8% rise in February, household operations, furnishings & equipment prices fell by 0.1% m/m. Clothing & footwear prices increased by a smaller 0.2%. Food prices rose by 0.4% m/m for the second month running, mainly due to higher restaurant prices.

CPI-median increased by 0.3% m/m in March, but CPI-trim rose by a smaller 0.2% and the February gains for both were revised down to 0.2% m/m, from the previous 0.3% (unlike the other price indices, CPI-trim and CPI-median can be revised due to changes in the seasonal adjustments). As a result, the average three-month annualised gain for the two core measures eased to a 16-month low of 3.4%. Absent a large rise in core prices in April, the three-month annualised should slow further in the next couple of months, giving the Bank further confidence that headline inflation will slow toward the target range.

Matthieu Arseneau and Alexandra Ducharme, economists with National Bank Financial

While the Federal Reserve could still raise rates in May, this morning’s data should convince the Bank of Canada that the pause is still appropriate. For the first time since early 2020, the real policy rate (using headline inflation) is in positive territory, something that has rarely happened in recent history. Inflation will also fall further below the policy rate in the coming months, thanks to other favorable base effects. Indeed, the months of strong inflation spikes following the start of the war in Ukraine will be removed from the calculations, as the negative base effect will disappear from the year-on-year changes. Such a restrictive monetary policy should be sufficient to significantly calm the Canadian economy in the coming quarters and, as a result, further cool inflation.

We expect goods components to continue to moderate. The problems in the supply chain are much less acute than they were a few months ago, as evidenced by the Bank of Canada’s latest pulse in its Business Outlook Survey. And the situation could continue to improve in a context of higher inventories, much lower transportation costs, price cuts by Chinese producers, and weaker global demand, all of which point to a lull in merchandise prices. The Bank of Canada’s survey has also eased our fears of a prolonged wage-price spiral, as the share of firms experiencing labor shortages has fallen sharply. All in all, we remain confident that annual inflation will fall below 3.0% this summer and approach the 2.0% central bank target by the end of the year, which is consistent with our view that the Bank of Canada’s tightening is over and that easing could start in the last quarter of the year.

Jay Zhao-Murray, forex market analyst, Monex Canada

The general takeaway of the report is, with headline inflation decelerating sharply, and core pressures either unchanged or marginally improved depending on the metric, the Bank of Canada will likely view this print as in line with its current forecast for 3% [inflation] by mid-year. It is worth highlighting, however, that this marks three consecutive months where sequential inflation is well above target, with readings of 0.5%, 0.4%, and 0.5% MoM from January through March. To be consistent with 2% annually, though, the monthly readings would need to be much lower, at around 0.165%. Additionally, while 3-month core prices decelerated sharply from the 7-8% zone last May to the 3-4% zone last August, we have seen many months of slow, grinding progress in these metrics. There is good reason for the Bank of Canada to be concerned about its upside risk of stickier-than-expected services inflation, and while today’s report does not scream “hike next meeting,” we still see a considerable risk that the Bank hikes again this cycle.

Charles St-Arnaud, chief economist, Alberta Central

Inflationary pressures remain broad but are narrowing slightly, with about 55% of the components of CPI rising at more than 5%, compared to 63% in February. However, the share of components rising by more than 3% was little changed at 72%. A reduction in the percentage of components rising by more than 5% will be welcomed by the Bank of Canada as a sign that the worst in terms of inflationary pressures may have passed. ….

Inflation has clearly peaked and continues to moderate. However, it remains well above the BoC’s target of 2%, inflation expectations are elevated, and inflationary pressures remain broad and likely sticky. Nevertheless, the BoC will welcome an inflation dynamic, as measured by the 3-month annualized changes, consistent with inflation reaching the upper band of its inflation target. In our view, this supports the case for the BoC to leave its policy rate unchanged at 4.5% for the rest of the year.

With a report from Reuters

Comments are closed.