“I wish I’d started saving earlier…”

Ask most baby boomers what their one big financial regret is, and this one is likely to be near the top of the list.

If they’re not already retired, most boomers are not far off; when you’re in your twenties however, retirement feels a long way away.

You’re just starting your career (or maybe haven’t even settled on one yet) and will be facing a host of very modern challenges: soaring student debt, the higher cost of living and dwindling job prospects. It’s therefore no wonder many young people are sorely tempted to put off investing until their finances are on a surer footing.

But there’s one big reason why a delay like this could be a very expensive mistake. You could be missing out on the phenomenon of ‘compounding’.

What is compound interest?

Financial experts get very excited about the concept of compound interest. It’s a key component that, used successfully, has the potential to give your overall savings a serious performance injection.

In simple terms, compounding means you earn interest not just on the principal investment (your initial deposit), but on the reinvested interest as well.

So, if you started with€100, and earned 10% interest, after year one, you’d have€110. By year two it would have gone up to €121. It’s not free money, but it’s probably as close to it as anyone is ever going to get. (As a side note, compound interest also works the other way – it’s the reason that credit card debt builds up so quickly if left unchecked).

A tale of two investors: compounding in action

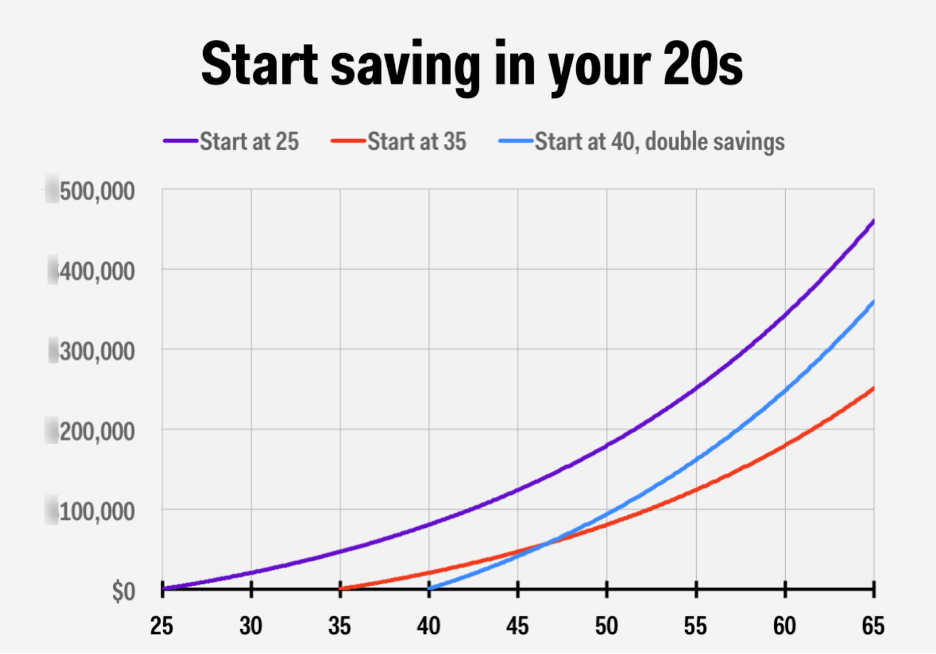

The crucial advantage of compound interest is time. With the right amount of it, you can achieve your financial goals using ‘less’ of your own money.

To witness the power of compounding, let’s look at two hypothetical investors – Brian and Becky.

Becky starts saving early. She manages to put aside€1,000 a year into an investment fund from age 20. Brian holds off, preferring to start investing when he’s got more disposable income and can ‘afford’ to invest. He doesn’t make his first payment until his 30th birthday.

For the sake of fairness, we’re giving them both the same rate of interest, 7% – a fairly conservative rate of interest compared with other potential investments. Both investors pay in the same amount every year for the 25 years. Even though, over the course of their careers, Brian and Becky pay in the same amount -€25,000 – the end result when they reach 65 is remarkable.

The effect of compounding, with an annual rate of interest of 7%. For illustration purposes only. Past performance is not a guarantee of future returns.

While Brian still retires with a sizeable return, Becky finishes with around twice the amount in her pot. That’s because, even after she stops putting money in, the accrued interest continues to compound. That extra decade could make all the difference all those years later.

Missed the boat? There’s still time to start

All this is very well in hindsight, but what happens if you missed the opportunity to start early?

Well there’s no need to give up hope. There’s an old adage “The best time to plant a tree was 20 years ago; the second-best time is now.”

It’s true that starting a decade, (or even two decades) later means you won’t have the full benefit of compounding, but it’s not too late to start building your nest egg.

And one of the most crucial pieces of financial advice in these circumstances is to stay invested. We can see from recent history that investors who have most successfully weathered storms such as the global financial crisis or 2020 pandemic – which saw massive falls in the global markets – were the ones that didn’t panic and try to pull their money out.

Thanks again to the miracle of compounding – letting the accrued interest do the work for you – an investor who went the distance over the last 20 years is more likely to have seen greater returns than one who tried to time the market by pulling out when share prices dropped.

Starting younger means you have got more options, but with a range of asset classes and growing markets there are opportunities for other investors too. Talk to us if you’d like to find out more.

Comments are closed.