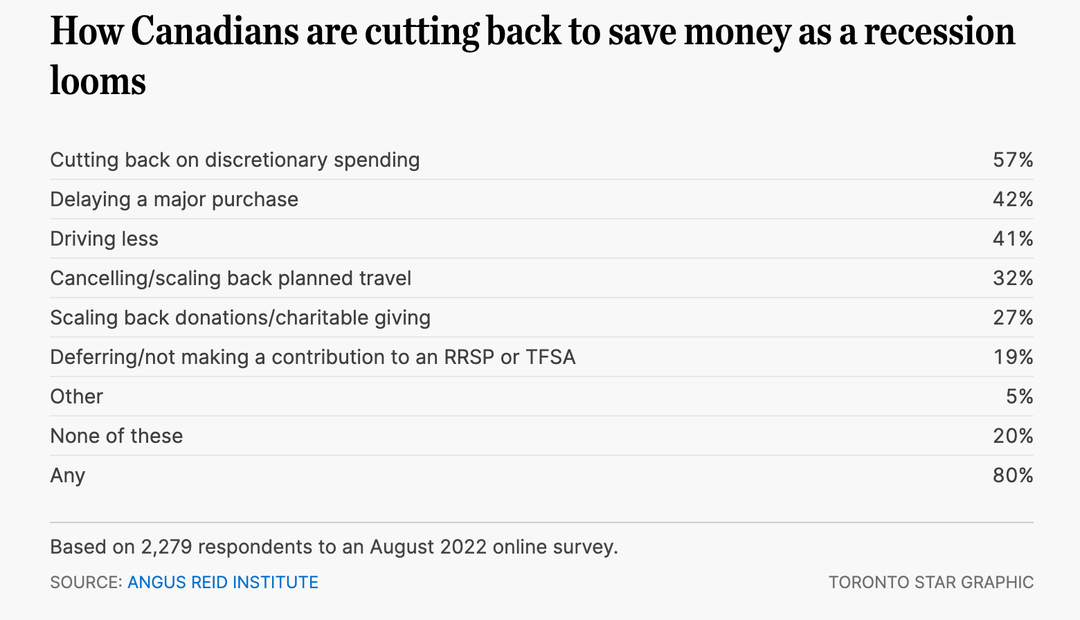

Around 80 per cent of Canadians are concerned that a recession will occur by the end of the year. While you can’t fully recession-proof your finances, you can take a few steps to protect your funds during an economic downturn.

As the risk of a recession grows, personal finance expert Rubina Ahmed-Haq recommends avoiding big-ticket purchases, such as a car or vacation.

iStock-1214933984.jpg

“That big purchase might seem fine now, but six months from now, you might wish you saved that $5,000.”

Instead, stash that money into an emergency fund, says Ahmed-Haq. To figure out how much you will need, she recommends writing down your necessary expenses for three months, including grocery bills and utilities. Then, calculate your monthly average from that amount. Ideally, your emergency fund should cover three to six months worth of expenses.

If you’re worried about losing your job, your emergency fund should account not just for wages but for things that your company would’ve covered. “That could mean prescriptions, dental, vision care, and life, critical illness and disability insurance,” says money expert Jessica Moorhouse. “Factor some of those costs into your emergency fund so you can still afford to visit the dentist or afford private insurance while you’re between jobs.”

You don’t necessarily have to park your emergency funds in a chequing account. Ahmed-Haq suggests putting it into an investment account that’s not an RRSP or TFSA, which will probably pay you better than a high-interest savings account. Money market accounts are very liquid, which means you can easily get that money out, she adds.

Next, tackle your high-interest debt — debt with annual interest of 10 per cent or higher — to free up cash flow. This includes prioritizing credit-card debt and payday loans. After you’ve set up an emergency fund and a plan to pay off high-interest debt, you can focus on investing for your future, Moorhouse says.

“Put the focus on saving rather than spending until we can start seeing prices come back to normal levels,” Moorhouse says. “One thing I’ve been seeing a lot of people do recently is challenging themselves to do a ‘no-spend month’ in which they only spend money on the essentials to see how much extra money they can save instead of spend.”

Comments are closed.